Heineken buys craft brewer Jack Black

Heineken is beating AB-InBev at their game, at least in South Africa. In early February 2018 the Dutch brewer bought a minority stake in craft brewer Jack Black from Cape Town. No financial details are known. According to estimates, Black Jack sold about 20,000 hl beer last year.

This is Heineken’s third investment in South African craft brewers in less than twelve months. In March 2017 Heineken bought Stellenbrau, a craft brewer located in the Stellenbosch wine region north of Cape Town.

Later, in September 2017, they purchased the popular craft beer brand Soweto from the eponymous Johannesburg township, whose tagline “Born in Soweto, brewed for all” cleverly syncs with South Africa’s image as a rainbow nation. The former SAB brewer Ndumiso Madlala and his business partner, the Swedish-born serial entrepreneur Josef Schmid, launched the label in 2012.

Soweto Gold is already being brewed at Heineken’s Sedibeng brewery in Johannesburg and packaged in 750 ml returnable bottles to increase its affordability. In the past few years volume sales have mostly been driven by 750 ml and 660 ml returnable bottles.

And now it is Jack Black’s turn. Founded by Ross and Meghan McCulloch in 2007 and initially brewed under contract, the pair only dared to open their own brewery in 2016.

Cape Town and environs are South Africa’s centre of craft beer, which could explain Heineken’s interest in the area’s craft brewers.

From what we have heard, another Cape Town brewer also changed hands last year. Allegedly, the craft beer pioneer Devil’s Peak clinched a deal with the global restaurant group Yum! (KFC, Pizza Hut, Taco Bell). Insiders say Devil’s Peak, whose brewery was built in 2013, could soon be brewing Guinness under contract.

Craft beer is a tough business in South Africa, not least because of AB-InBev’s near-total dominance of the market. AB-InBev bought the local behemoth SAB in 2015. Though declining, SAB’s market share, according to Euromonitor, is still 80 percent. Heineken, which built their own brewery in 2010, have struggled to hike their market share to an estimated 13 percent.

To prevent the country’s 200 or so microbrewers from making wider inroads into the high-end segment of Africa’s biggest beer market, the two Big Brewers are selling their domestic and international brands at very competitive prices.

For the price of six bottles of CBC, the major domestic craft brewer, you can get 18 bottles of Black Label (AB-InBev).

A wobbly economy does not help either. At the end of 2017, GDP per head was falling and unemployment was running at 28 percent.

2018 could prove an even tougher year for South Africa’s craft brewers. The country is in the throes of a water shortage. Cape Town has been hit hardest. It's been a slow-motion crisis, exacerbated by the worst drought in more than a century and the metro area’s population, which is four million and growing quickly. Only craft breweries with their own water supplies will be able to cope.

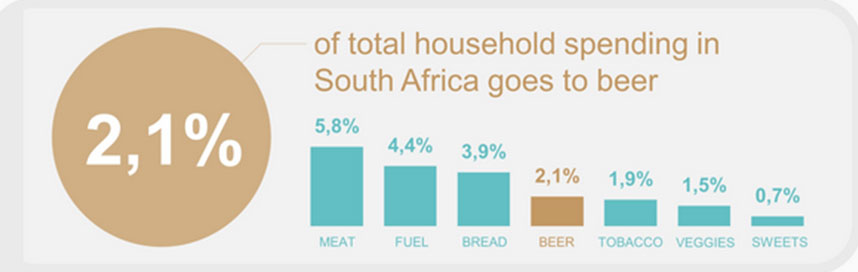

Still, South Africans like their beer. Beer production was 32 million hl in 2016 or nearly 60 litres per capita. The Statistics Office, Stats SA, said that in 2016 beer accounted for 2.1 percent of total household spending. This was the same as that spent on personal care (2.1 percent), but higher than tobacco, vegetables sweets and desserts and fruit.

Beer is the most popular alcoholic beverage. Over half of household spending (54 percent) on alcoholic beverages was devoted to beer. Wine and spirit coolers came in second at 25 percent, followed by spirits at 21 percent.

Keywords

international beer market beer consumption South Africa beer production

Authors

Ina Verstl

Source

BRAUWELT International 2018