Craft beer growth could turn negative in 2019

USA | With New Belgium’s 100 percent sale to Lion, a major craft brewer will exit the Brewers Association’s ranking.

The loss of the designation as a small and independent brewer does not seem to faze New Belgium’s chair Kim Jordan. Her only comment per brewbound.com: “the world evolves.”

One group, whose response will be interesting to see, will be the Brewers Association’s (BA), says the website pastemagazine.com. The BA publishes yearly statistics on the growth of the industry. New Belgium ranked fourth overall in terms of total production on the 2018 list of the 50 largest “craft” breweries. Only those craft brewers are included that adhere to the BA’s definition of a small and independent brewer.

The departure of New Belgium will be a big hit in terms of production coming off the books for the BA.

Will the math show an uptick in sales?

Pastemagazine.com wonders: Could the loss of New Belgium’s numbers lead to the first year that sees negative growth in the BA-defined “craft” sphere in more than a decade? It certainly isn’t going to help to deduct 850,000 barrel beer from the bottom line.

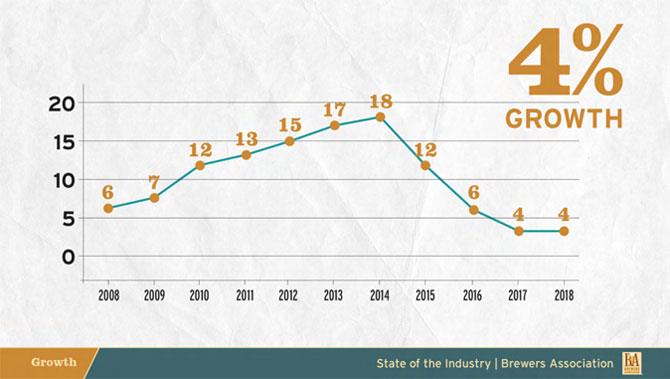

In August 2019 the BA reported a 4 percent growth in craft beer sales during the first six months of this year. In 2018, craft beer sales expanded by 4 percent.

BA’s equivocal comment

After the sale of New Belgium, Bob Peace, President and CEO of the Brewers Association, had the following to share with brewbound.com:

“As mass market lager and light lager have been volume challenged in developed markets, we’ve seen global brewers look to tap into the dynamism of the craft segment. The craft brewing market has also become considerably more competitive in recent years, particular for regional brewers with a widely distributed footprint and significant capacity. A decade of double-digit growth for craft brewers has decelerated into a more mature market. As such, global brewers acquiring small US brewers has generally slowed as a trend. Every brewer will make their own independent decision about how to respond to this competitive market, and we’ve seen a number of independent brewers choose acquisition by a strategic partner as their route.”

Sounds fairly non-committal, doesn’t it? But what else could he have said?

Read more about the sale of New Belgium in Ina's recent article and her analysis why New Belgium chose to sell.