PepsiCo to split in two and go after AB-InBev?

PepsiCo is receiving a lot of criticism from investors these days for its insistence on continuing as a snacks and beverage company. In early August 2011, PepsiCo’s shares were down 1.4 percent in the past 12 months, compared with a gain of 18 percent for its archrival, The Coca-Cola Company.

The idea – repeatedly put forth by Wall Street types – that PepsiCo should split into two and spin off its Frito-Lay snacks business, received new vigour after Kraft announced on 5 August 2011 that it will split its north American grocery division (with brands such as Kraft’s Macaroni and Cheese, Oscar Mayer meats and Philadelphia cream cheese) from its global snacks business (with brands such as Cadbury chocolate, Oreo biscuits and Trident chewing gum).

Kraft hopes to complete the split by the end of 2012.

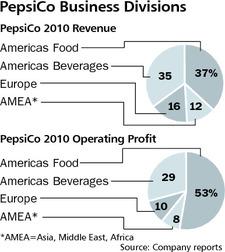

Although PepsiCo has 19 brands with USD 1 billion or more of annual sales, led by Pepsi-Cola, Mountain Dew, Lay’s potato chips, Gatorade and Tropicana juices, a severing of the two portfolios appears like a straightforward operation.

PepsiCo’s CEO Indra Nooyi is a shrewd woman. Even before Kraft announced its imminent transformation, she had started playing to the gallery of analysts by pointing out during the company’s earnings conference call in July 2011 that the Frito-Lay North American snacks business might be “the best consumer-products company” if it were a “stand-alone” business.

This suggests that PepsiCo’s shareholders might benefit from a split-off of the snack-foods business, given the higher valuation that Frito-Lay would probably receive.

The best structure would be a global snacks company and a global beverages company.

According to analysts’ estimates, the snacks company would be USD 33.2 billion in sales and USD 6.2 billion in EBIT, while the beverage company would be USD 36.1 billion in sales and USD 4.8 billion in EBIT.

Pepsi has been reluctant to break up the company because of what it calls the “power of one” – namely, that ownership of snacks and beverages has helped both businesses through joint marketing programmes and other initiatives. However, it is difficult to quantify the benefits, especially given Pepsi-Cola’s troubles in recent years, as the brand has lost market share to Coke.

PepsiCo’s market share in carbonated soft drinks trails Coke’s. Its case shipments in key brands fell in 2010.

Soft drink brands: Market Share (%) 2010

| Brand | Market share | Change |

| Coke(Coke) | 17.0 | 0.5 |

| Diet Coke (Coke) | 9.9 | -1.0 |

| Pepsi-Cola (PepsiCo) | 9.5 | -4.8 |

| Mountain Dew (PepsiCo) | 6.8 | 0.5 |

| Dr Pepper (DPS)* | 6.3 | 2.8 |

| Sprite (Coke) | 5.6 | 2.0 |

| Diet Pepsi (PepsiCo) | 5.3 | -5.2 |

| Diet Mtn. Dew (PepsiCo) | 2.0 | 5.8 |

| Diet Dr Pepper (DPS) | 1.9 | 5.6 |

| Fanta (Coke) | 1.8 | 1.0 |

*=Dr Pepper Snapple

Source: Beverage Digest

PepsiCo, to all appearances, has taken the analysts’ call for "doing a Kraft" seriously. On 8 August 2011 a spokesperson for PepsiCo was reported as saying that the company has no plans to follow Kraft. “We have a very different portfolio to Kraft and their decision does not change our strategy”, said the company spokesperson.

Although PepsiCo has issued a strong denial, the whole issue has led to renewed speculation about a merger between PepsiCo and AmBev, the Latin American unit of AB-InBev.

AmBev is the largest Pepsi bottler outside the United States. Following PepsiCo’s decision in August 2009 to buy the remaining stakes in its two largest North American bottlers – Pepsi Bottling Group and PepsiAmericas – many have been wondering if AmBev could be next in line.

While this kind of merger – alcoholic and non-alcoholic beverages – seems illogical in mature markets for the lack of obvious synergies, it could make some sense in emerging markets (think joint distribution) where these companies are bringing in their big profits.

From PepsiCo’s point of view such a combination could be beneficial. Whether the same could be said for AmBev is another matter. AmBev’s beer business is probably twice as profitable (as measured in EBIT margin) as any soft drinks business can ever be.

For the time being, any of the above – PepsiCo’s demerger and a subsequent combination with AmBev – is just idle talk. But one should never underestimate investors’ grumblings. As history tells us: no stock market-listed company can afford to resist investor activism for long.