Heineken banks on premium segment growth

So much for those lofty economic growth forecasts. Both Brazil and Mexico have had to revise their GDP growth rates down: Brazil is heading for growth of less than 3 percent this year, while Mexico is expected to expand by 1.2 percent. Beer markets have taken a hit. Consumption of beer in Brazil and Mexico is expected to decline in the low single digits this year.

Still, Heineken remains upbeat. At an investor conference in Mexico on 5 and 6 December 2013, the Dutch brewer said they are stepping up their drive into the premium beer market in Mexico. It’s going to be tough, though.

For one, beer is ubiquitous in Mexico – and fairly cheap. Persuading consumers to switch from their cheap lager of choice to a premium brand, at higher cost, might prove an uphill struggle. Premium beers only account for less than 5 percent of Mexico’s USD 7.5 billion beer market, Heineken says.

For another, Modelo, the country’s biggest brewer, might not relinquish market share all that easily. Heineken, which bought Mexico’s number two brewer FEMSA Cerveza in 2010 (with brands Tecate, Dos Equis, Sol, Bohemia and Indio), is up against AB-InBev, which took over Modelo this year (the maker of Corona and Estrella beer). AB-InBev has 58 percent of the market compared to Heineken’s 41 percent.

Also, this year the Mexican beer market contracted as the economy slowed and hurricanes crimped spending in September. Everybody hopes that the economy will pick up again next year and take beer sales with it.

Heineken has avoided a revenue decline in Mexico, thanks to price increases and improved sales of higher-end brews such as its namesake brand. The premium segment may post a compound annual growth rate of 17.3 percent in the 2012 to 2017 period in Latin America and the Caribbean.

All this is idle speculation. Heineken reported third-quarter beer volume that fell 2 percent in the Americas, and said Mexican volume declined “slightly”. AB-InBev said its Mexican volume fell 2.3 percent in the third quarter 2013.

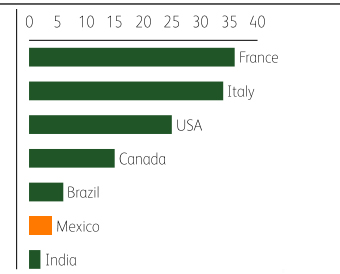

Premium segment’s share of the market