AB-InBev wants to move into distribution in Kentucky

Kentucky seems to be the latest in a string of states where AB-InBev has sought to grow into distribution through buying up willing distributors. In August this year, AB-InBev applied for a distributor's license in the city of Owensboro, Kentucky. The licence request came out of a deal to acquire Budweiser of Owensboro, a distribution company owned by Tennessee-based Hand Family Companies.

However, several independent distributors, wholesalers and brewers are fighting the move and state regulators are considering whether to wave it through or not. Hence AB-InBev filed a lawsuit in Franklin Circuit Court at the end of October 2014 in an effort to expedite that process. A prehearing conference has been set for 21 November 2014.

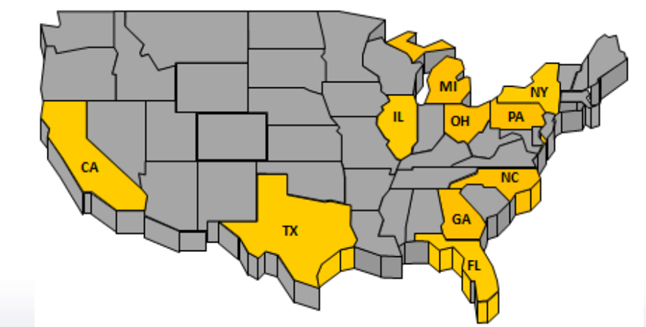

For years, AB-InBev has tried to move into distribution to wring more profits out of the value chain. Despite the Three Tier System, which by law separates companies that make beer, ship it, and sell it to consumers, these kinds of acquisitions are legal in about 20 U.S. states.

In Illinois, AB-InBev tried to buy Chicago-based distributor City Beverage in 2009. After years of court battles, Illinois’ legislators forced the company to unload its share in City Beverage in 2013. Who was the buyer? The very same Hand Family that is now trying to sell its Kentucky operations to AB-InBev.

Also last year, AB-InBev tried to buy C&G Distributing Co. in Lima, Ohio, but the move was also blocked by the Ohio Legislature – “after wholesalers poured boatloads of money into legislators' campaigns”, newspapers wrote.

This year, AB-InBev got lucky when in January it managed to buy a distributor in Portland, Oregon, for an undisclosed sum.

AB-InBev has always denied that it is trying to take over beer distribution, noting that it owns merely 17 of the 500 distributors across the nation which sell its products. In AB-InBev’s lingo they are called “branches”. It’s been estimated that these branches already represent between 8 and 10 percent of AB-InBev’s beer volume.

However, there are many questions surrounding AB-InBev’s desire and ability to acquire more distributorships. Most of these purchases are private transactions and little is known about the specifics of the deal and market strategy. The old Anheuser-Busch once stated that they buy branches where distributors are bankrupt, failing, or where there are no other buyers available.

This does not appear to be the case in Kentucky. Rather, this looks like a straightforward purchase for AB-InBev to gain greater access to the middle tier of distribution, which bigger companies like the Hand Family are exiting in their effort to focus on big franchises only.