Craft brewers up in arms over AB-InBev’s new incentive plan

So much for the Three Tier System allegedly protecting smaller brewers. Thanks to their financial muscle, the Big Brewers always seem to find ways and means to get around it.

AB-InBev’s latest plan to reverse declining volumes in the U.S. by rewarding distributors with money if they focus on AB-InBev’s brands is raising alarm among craft brewers: they rightfully worry that it will become much harder for them to get their beers on to shelves if distributors chose not to carry them.

According to U.S. media, AB-InBev in November 2015 introduced an incentive programme that could offer some independent distributors in the U.S. annual reimbursements of as much as USD 1.5 million, provided that 98 percent of the beers they sell are AB-InBev brands.

The incentives are staggered according to the AB-InBev volumes the distributors carry. For example, distributors whose sales volumes are 95 percent made up of AB-InBev brands would be eligible to have the brewer cover as much as half of their contractual marketing support for those brands, which includes retail promotion and display costs.

As the Wall Street Journal reports, AB-InBev estimates that participating distributors would receive an average annual benefit of USD 200,000 each.

The brewer, which has more than 500 distributors in the U.S., said the incentive programme is part of a three-year plan to restore growth in AB-InBev’s most profitable market. It includes additional marketing and sales commitments of about USD 150 million next year, it was reported.

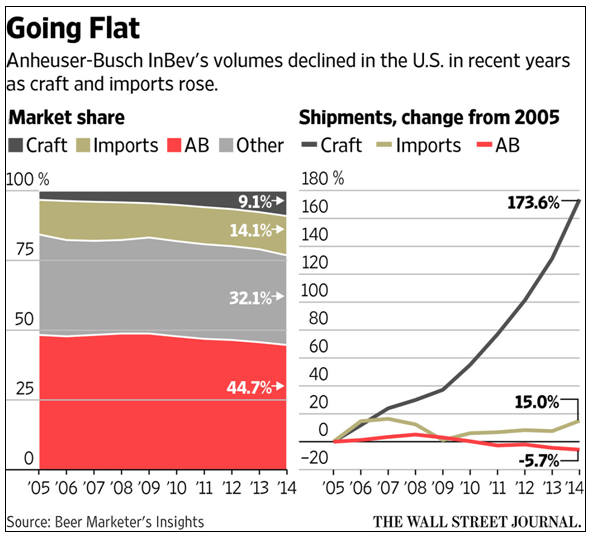

No doubt, AB-InBev has been between a rock and a hard place since acquiring Anheuser-Busch in 2008. Its production has declined by 11 million barrels between 2008 and 2014 and its market share dropped to 45 percent from 49 percent, according to estimates by Beer Marketer’s Insights.

With AB-InBev buying up distributors in U.S. states where this is legal, competition concerns have risen. U.S. media say that the California Attorney General and Justice Department are investigating AB-InBev’s recent acquisition of two Californian distributors to determine if those acquisitions make it harder for craft brewers to find distribution.

Craft brewers fear AB-InBev’s new incentive programme could do just that.

AB-InBev allegedly told its distributors that they could qualify for the incentive programme if the craft brewers they carry are really tiny, which means they must produce less than 15,000 barrels or sell their beer in one state only.

Ever outspoken, Tony Magee, the founder of California’s Lagunitas brewery, who sold half of his company to Heineken earlier this year, said the cap could curb distributors’ motivation to increase craft-beer sales because rising demand could push production beyond the 15,000-barrel threshold.

However, most of the 3,500-plus craft brewers produce less than 15,000 barrels (17,500 hl) beer.

Adding to craft brewers’ concern is AB-InBev’s acquisition of five U.S. craft breweries in the past few years.

Incentive programmes and exclusivity contracts are widely used by brewers the world over to draw distributors and publicans close to their chest. In most countries they are legal, but this has not stopped brewers from coming under fire for them.

In 1997, the old Anheuser-Busch incentive system already drew a Justice Department investigation. The so-called “100 percent Share of Mind” programme included incentives and restrictions to dissuade distributors from carrying smaller brands. The probe ended without legal action.

Craft brewers have expanded their market share since then to about 11 percent in 2014.