AB-InBev buys Virtue Cider company

With all that heady deal-making in the U.S. craft beer sector, the world’s largest brewer AB-InBev did not want to be left out. However, AB-InBev’s subsidiary Goose Island decided to buy into the booming cider category by taking a majority stake in the Virtue Cider Company, which is located in Michigan and known for its barrel-aged ciders. Virtue Cider's brands include RedStreak, an English style cider, and The Mitten, a bourbon barrel aged cider.

Announced on 4 September 2015, the deal comes four years after Goose Island’s brewmaster Greg Hall, son of founder John Hall, left the Chicago brewery when it was sold to Anheuser-Busch for USD 38.8 million. The same year, Greg Hall and his business partner Stephen Schmakel founded Virtue Cider in Fennville, Michigan.

Terms of the deal and the percentage stake Goose Island will hold in the company were not disclosed. Mr Hall and 31 other investors will retain a “significant” minority stake in Virtue. Also, Mr Hall and Mr Schmakel will stay with the company in a “creative and operational capacity”.

Virtue will use Goose Island's brewery in Chicago for packaging, and as a hub for distribution.

Links between Goose Island and Virtue were strong even after Mr Hall’s exit because Mr Hall has had a seat on Goose Island's board and has continued to consult with it on beers and marketing.

Goose Island is a wholly owned subsidiary of Anheuser-Busch, but the Chicago brewery maintains “a good deal of independence” from its parent. Goose Island’s General Manager Ken Stout was quoted as saying: “This is a Goose Island and Virtue [joint venture]. There was no coercion from our parent company on pursuing the deal, nor any constraints.”

In 2009, alcoholic cider (or hard cider as it is called in the U.S.) was a USD 35 million market. But, thanks to annual growth rates of over 50 percent, sales reached USD 366 million in 2014, according to research firm IRI. Volume has increased from 62 million litres in 2011 to 314 million litres in 2014, it was reported. Nevertheless, cider is a small segment, accounting for only 1 percent of the U.S. beer market.

The U.S. cider market differs considerably from its European counterparts. It is skewed towards young consumers and women and off-premise consumption. In the off-trade, cider sales grew 72 percent in 2014 to reach 231 million litres (74 percent of total volume), while on-trade volume grew 44 percent to reach 83 million litres (26 percent of total volume).

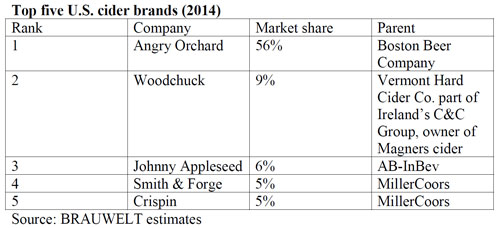

According to the U.S. trade publication Impact, the top five cider brands in 2014 combined represented 81 percent of market volume, with the majority of these brands only established since 2011.