AB-InBev hopes to reconquer lost ground in Colorado

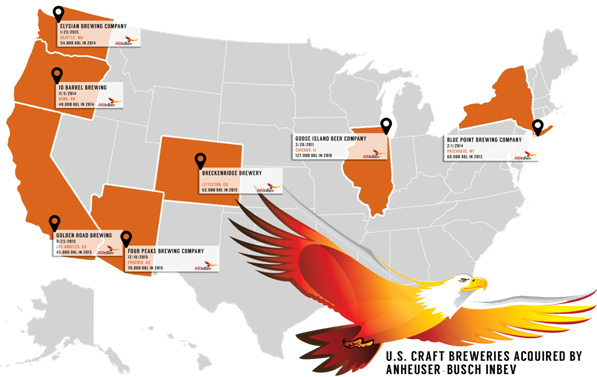

It’s so easy to get hoodwinked by the big guys. When shortly before Christmas 2015 AB-InBev picked up two U.S. craft brewers – Breckenridge in Colorado and Four Peaks in Arizona – the craft beer commentariat around the world screamed “oy vey”.

When AB-InBev bought a few distributors last year, only a few insiders pulled a frown. Why is this so? Because craft brewing is sexy, while distribution is dull?

In the case of AB-InBev’s recent acquisitions, we need to look at the full picture. In actual fact, it is through the acquisition of Breckenridge and two distributors in Colorado that AB-InBev hopes to recover lost ground in this federal state.

What makes Colorado such a battle ground is that it eventually could turn into a “swing state”, meaning that if AB-InBev continues to lose beer sales there, in the long run craft and imports could outsell the two major brewers. AB-InBev and MillerCoors should be haunted by the specter of Portland, Oregon. In the city of Portland craft beer dominates the retail market with AB-InBev and MillerCoors only enjoying a combined market share of about 40 percent, according to estimates.

In terms of craft breweries, Colorado already ranks among the top five states.

Beer Marketer’s Insights, a trade publication, says that AB-InBev has lost market share in Colorado between 2007 and 2014. In 2014, its market share had dropped to below 35 percent – its domestic market share is 45 percent.

In order to stem this worrisome decline, AB-InBev will have had to spend quite some money on Breckenridge and the two distributors – no rumours here as to how much – but it will have been worthwhile because Breckenridge alone will add 1.0 percentage point to AB-InBev’s current market share, Beer Marketer’s Insights says. Some may argue that one percentage point is a small gain for the presumably huge outlay, but others will maintain that it’s a start.

In comparison, AB-InBev’s acquisition of two distributors in Colorado is much shrewder. With these deals AB-InBev now owns over 75 percent of its distribution in this state, even after agreeing to sell off a few million cases of beer sales to Steven Busch, half-brother of August Busch IV and owner of Krey Distributing Company, which is classified as an independent wholesaler.

It’s assumed that by controlling its own distribution AB-InBev will be able to push its own brands, craft and other, much harder while narrowing the route to market for other craft brewers. This is what allegedly happened in Oregon after AB-InBev bought two distributors there between 2011 and 2012.

Unbeknown to many, AB-InBev has also become a retailer in recent years, thanks to the various brewpubs and restaurants that have come with the craft beer deals. Again according to Beer Marketer’s Insights, AB-InBev will own at least 15 retail outlets across the United States. In Colorado, AB-InBev will get the original Breckenridge brewpub and a restaurant. In addition, AB-InBev this year will open a 10 Barrel brewpub in Denver (it bought Oregon’s 10 Barrel brewery in 2014), which adds up to AB-InBev owning two breweries (Breckenridge and its own Fort Collins brewery), three restaurants and three distributors in this state. Not bad.

Beer Marketer’s Insights rightly wonders what AB-InBev plans to do with these brewpubs and restaurants? Are they just for branding and sampling purposes, as AB-InBev says, or are they meant to disrupt the system? Whatever the case, although the brewpub sales may not exactly rev up AB-InBev’s profits, they should nevertheless have everybody take note as they represent a further blurring of the lines between the three tiers.

AB-InBev’s craft beer deals in the U.S. 2011-2015

Keywords

USA acquisitions international beverage market mergers

Authors

Ina Verstl

Source

BRAUWELT International 2016