Import segment still larger than craft beer

Given the general consternation over craft beer’s slower growth – only six percent in volume in 2016 – the fact that the craft beer category was outgrown by imports – seven percent – almost went unnoticed. What’s more, imports are still a bigger segment than craft.

According to data by the Brewers Association, 33 million barrels (38.6 million hl) of imported beers (17 percent market share) were sold in the US in 2016, compared with 24 million barrels of craft beer (or 12.3 percent).

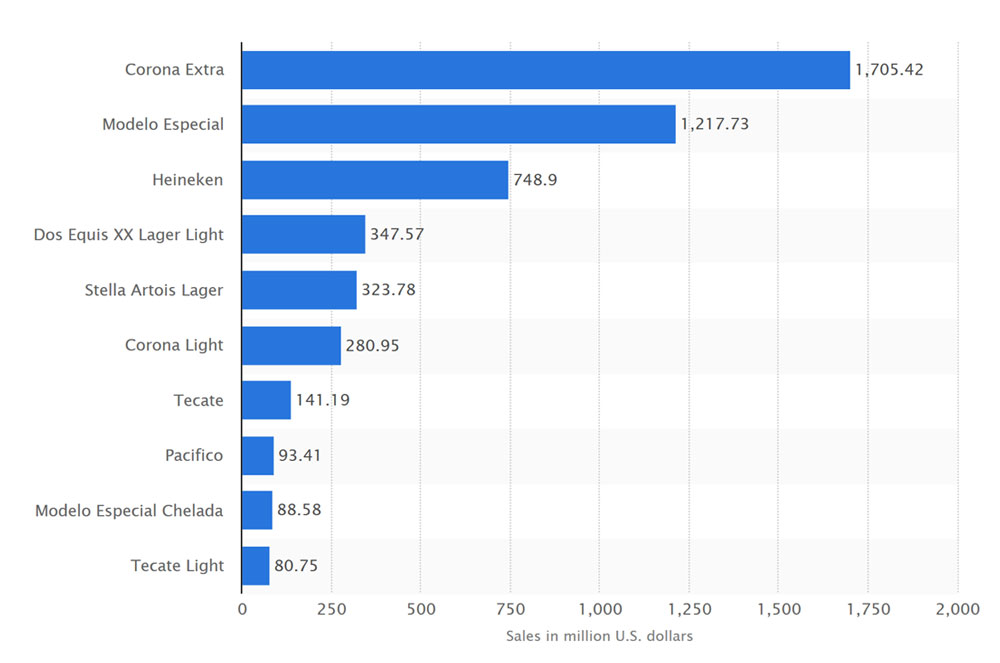

Chicago-based market research firm IRI says that Mexican beer has accounted for nearly 70 percent of imported beer sales during the past year and is growing. Nine of the nation’s top 54 brands are Mexican imports, including two of the top seven (Corona Extra and Modelo Especial).

The old faithful top four brands – Bud Light, Coors Light, Budweiser and Miller Lite - are all down or flat from a year ago while their Mexican competitors are up: Corona nearly nine percent, Modelo Especial 24 percent and Modelo Negra (recently renamed from Negra Modelo), Pacifico and Modelo Especial Chelada all between 20 to 30 percent.

So why are Mexican beers so popular? Media commentators think it is due to a complex mix of demographics, marketing, history and nostalgia. “Mexico is the sun-dappled place where we are from. Or it is where our family is from. Or it is where we vacation. We adore its food. And its impact on our culture is growing”, it was pointed out.

Most major Mexican brands are currently in the hands of two dominant players: Grupo Modelo, owned by AB-InBev, though its brands in the US had to be divested to Constellation Brands, and Cervecería Cuauhtémoc Moctezuma, a subsidiary of Heineken.

While Constellation Brands has done a good job at growing the sales of Corona Extra in recent years, shipments in 2016 only reached the previous 2008 level, a panel of Wall Street analysts argued at the recent Beverage Forum, a high-level industry gathering in Chicago.

And as concerns Heineken, they concurred that the Dutch brewer cannot be too happy with its total volume sales in the United States. Even if its Mexican beer brands (Sol, Tecate, Dos Equis) are included, Heineken’s sales have only hovered around the 8.5 million barrel mark since 2006, whereas Constellation’s have soared. Besides, AB-InBev’s brand Stella Artois is taking market share away from the Heineken brand in the United States.

With Heineken “risking insignificance in the US”, several analysts judged the Dutch brewer to be ultimately in pursuit of a deal with Molson Coors, the number two brewer in the United States.

For the time being this may just be idle talk, but who knows what the future will bring for both Heineken and Molson Coors?