Will AB-InBev buy out Craft Brew Alliance?

The US rumour mill is working overtime that AB-InBev could buy out the listed craft brewer Craft Brew Alliance (CBA) from Portland, Oregon, with brands like Kona, Widmer Brothers and Redhook. AB-InBev already controls a 31.5 percent stake in the craft brewer, thanks to the old Anheuser-Busch having made an initial investment in Redhook in 1994 and in Widmer in 1998. Today the two are so enmeshed in each other’s affairs, analysts say, that it’s probably time the Big Brewer just took over the craft beer maker, lock, stock and barrel.

In February 2018 CBA, which is comprised of seven regional brewers, pre-announced its 2017 full-year earnings. It reported double-digit volume growth for the Kona brand, gross margin expansion, and per-share earnings of USD 0.14, which is a U-turn from the USD 0.02 per share loss it recorded last year.

At the same time, it announced a new agreement that will expand its relationship with AB-InBev, which many regard as proof that an even bigger deal is on the horizon.

As part of their new agreement, CBA will take on brewing responsibilities for AB-InBev’s craft beer subsidiaries in cases where using an AB-InBev plant would be inefficient. CBA owns and operates breweries in Portland, Oregon, and Portsmouth, New Hampshire, along with some other offsite warehouses.

It was pointed out that, in addition to the ownership stake, AB-InBev already has a major say in how CBA operates. It has the right to name two directors to CBA’s board of directors. It can have a representative on each committee of the board. It can limit CBA’s ability to issue stock or sell assets. It can prohibit CBA from selling its beer through any distribution network other than AB-InBev’s own. Not least, it can prevent CBA from delisting from the Nasdaq stock exchange.

Given those sweeping powers, CBA may as well be owned by AB-InBev in actual fact, observers say.

Another hint that a full takeover could be in the offing is the sudden and unexpected departure of CBA’s vice president of its emerging business unit, John Glick, in February 2018. Mr Glick has been with CBA since 2011. The emerging business unit, aka an M&A division, was shut down too.

The unit’s task was to target certain markets for CBA’s beers and enter into strategic partnerships with small brewers in the region, such as Appalachian Mountain Brewery in Boone, North Carolina, and Cisco Brewers in Nantucket, Massachusetts.

Observers argue that, if AB-InBev were to buy out CBA, this would almost certainly trigger an official Department of Justice review. While it has been speculated about for years that a merger would happen, now that both brewers are even more intertwined, this year may just be when AB-InBev finally takes the leap.

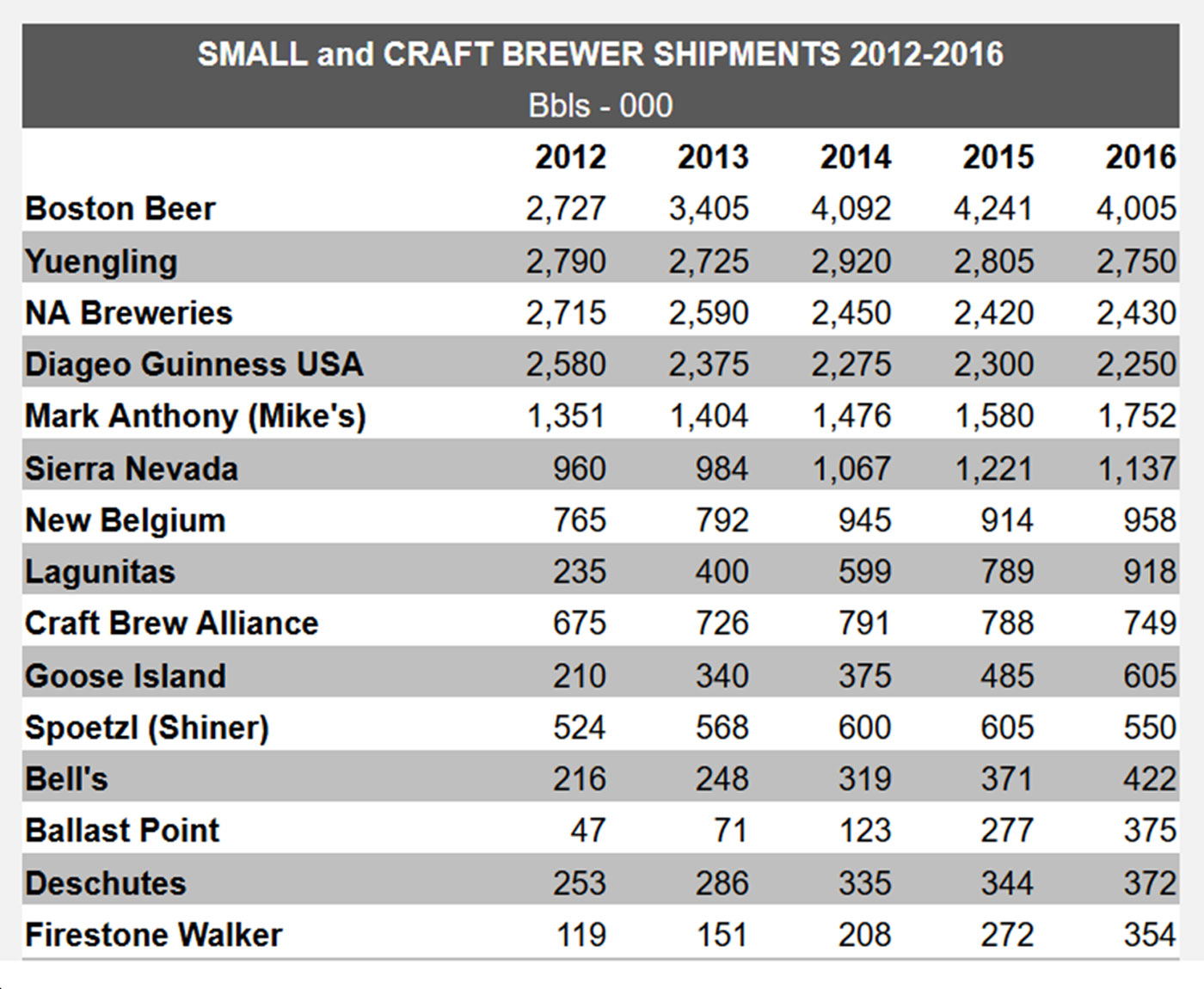

Craft brewer ranking according to Beer Marketer's Insights