MillerCoors survey confirms shift in bar traffic to taprooms

No doubt, the Three Tier System is being hollowed out. As more and more states grant craft brewers the right to open taprooms and even sell their beers to-go they are turning into serious competitors for distributors and retailers.

Miller Coors recently published a blog piece, which highlights the shift in consumption patterns: millercoorsblog

In 2017, craft-beer volumes grew just five percent, which represents the slowest growth in a decade. Most growth came from brewpubs and taprooms, whose volume sales rose 24.2 percent to 2.7 million barrels (3.2 million hl), according to the Brewers Association.

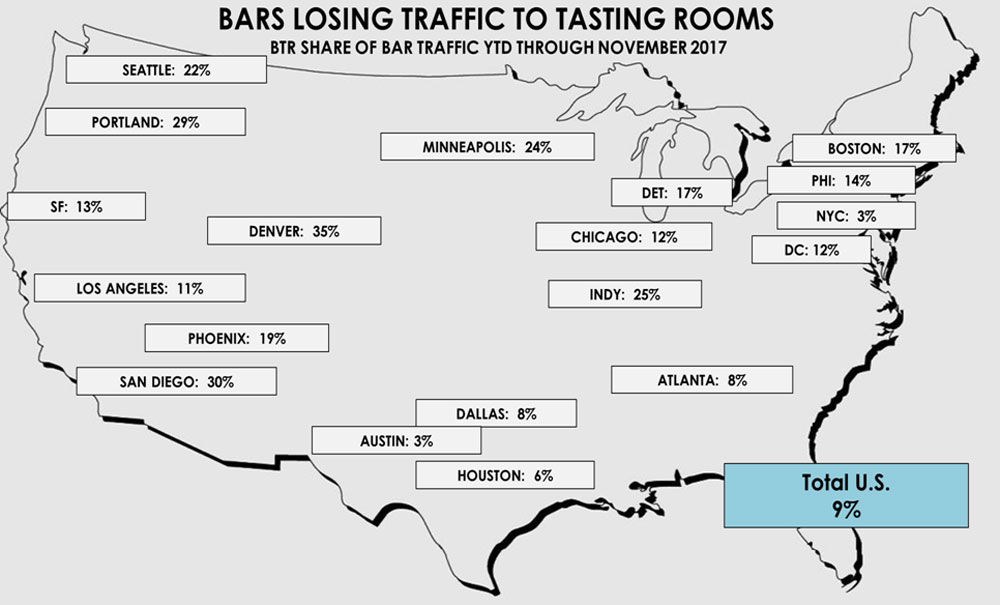

Already nine percent of bar traffic (that’s people) across the US now moves through brewery taprooms and brewpubs, according to data from MillerCoors. In cities like Denver and San Diego, which sport some 50+ and 200 craft breweries respectively, the figure is 35 percent. In Indianapolis, Minneapolis, Seattle and Portland, more than 20 percent of bar traffic now flows through taprooms.

Total on-premise traffic fell 3.6 percent in 2017, according to MillerCoors. Worryingly, surveys show that in five major cities (Denver, San Diego, Seattle, Phoenix and Detroit), about 80 percent of drinkers did not visit a bar following a trip to a tasting room.

Not only do craft breweries take visitors away from established bars, they are also “shifting the on-premise norms, visiting earlier in the day and then opting out and going home,” Molly Ballash, the MillerCoors category development manager for on-premise is quoted as saying in the blog. “Our bar partners are missing out on high-volume occasions like dinner and happy hour.”

By the way, MillerCoors, via its Tenth and Blake division, also operates taprooms in conjunction with its craft partner breweries as well as branded-experience locations that sell through the traditional, three-tier system.