Heineken banks on premiumisation strategy as volumes grew in 2022

Netherlands | The Dutch brewer’s volume sales returned to pre-pandemic levels in 2022, with premium brands outperforming the rest of the portfolio, Heineken reported on 15 February.

Volume sales rose 7 percent to 257 million hl beer. The brewer also reported net revenue growth of 31 percent to EUR 28.7 million (USD 30.7 billion), crediting inflation-driven price increases and its premiumisation efforts for the boost.

Heineken booked a net profit of EUR 2.7 billion last year, down 19 percent year-on-year, but said it was getting closer to its target of 13 percent net profit margin, thanks to cost cuttings, price increases and higher marketing spend.

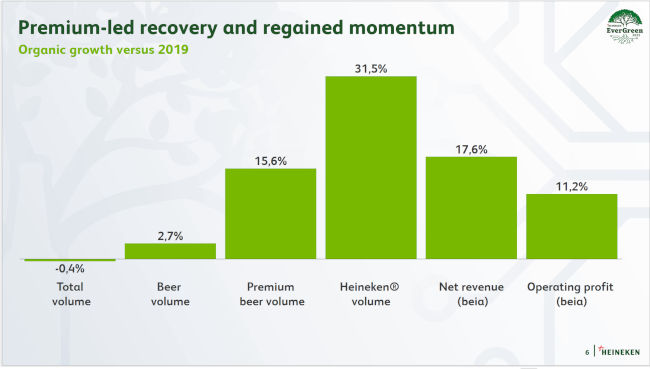

Since 2019, the last “normal” year, Heineken has seen total beer volumes rise organically by 2.7 percent, while premium volumes were up by 15.6 percent and the Heineken brand itself by 31.5 percent. This led to an increase in revenue of 17.6 percent over the four-year period. Since 2019, total beer and beverage volumes have declined 0.4 percent, though, partly because Heineken has discontinued some low margin soft drinks in Brazil.

Stepping up marketing spend

Heineken is planning to further restructure its portfolio towards the premium end. In 2022, it hiked its marketing and selling expenses to EUR 2.7 billion (or 9.5 percent of the company’s 2022 net revenue), from EUR 2.6 billion in 2019.

However, marketing spend is still lower than in 2019 as a percentage of revenue. Heineken’s CEO, Dolf van den Brink, said: “We really want to make sure that we earn pricing power through brand power,” thus assuaging analysts’ fears that the company’s price increases could hurt sales.

Going into 2023, Heineken has committed itself to continued investment in its brands, “whilst staying disciplined on pricing and costs”. It let on that the bulk of its price increases in Europe will happen in the first half.

Heineken expects operating profit to grow organically by mid- to high-single-digits in 2023, while volume sales will grow modestly or remain stable. However, it expects volumes to fall in Europe this year, as a “challenging” macroeconomic environment will hit consumer spending. The brewer reported that 2022 on-premise beer sales in Europe had not recovered 2019 levels.

Analysts have closed the book on Russia

As to its Russian business, Heineken said it took an impairment charge of EUR 88 million (USD 94 million) in 2022, far less than the initially forecasted charge of EUR 400 million. It stated it was making progress “to transfer the ownership of our business in Russia whilst dealing with frequently changing regulations. We remain optimistic in our ability to reach an agreement in the coming months.” No further details were provided, and the analysts did not come up with any questions either.

Keywords

international beer market beer price sales beer sales The Netherlands company reports international brewing industry inflation

Authors

Ina Verstl

Source

BRAUWELT International 2023