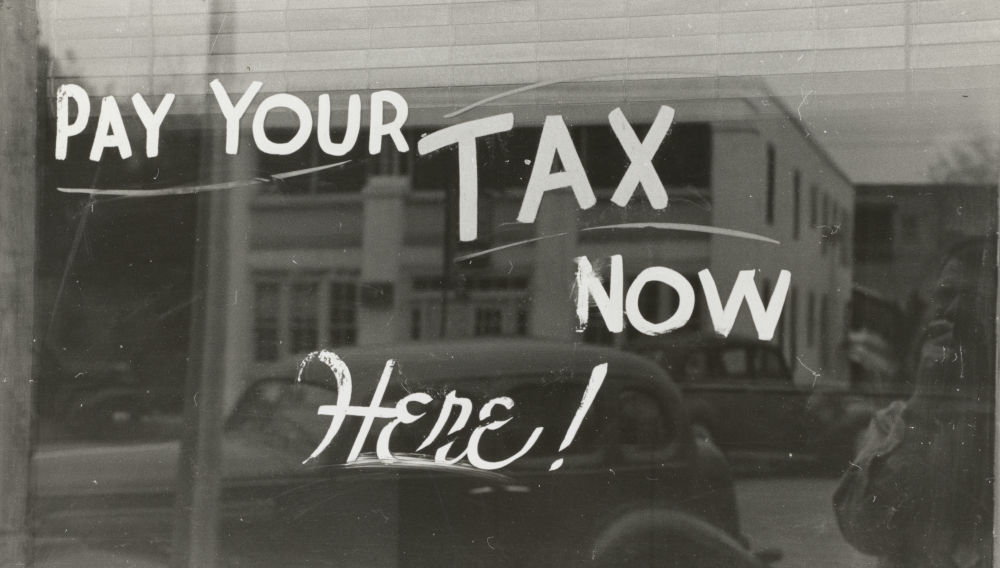

Tax the rich: the Belgian way

Belgium | The AB-InBev connection is spurious at best, but this has not stopped Belgian media to sell a bizarre story about tax planning gone wrong as a love and crime story, involving the late Amicie de Spoelberch, her heirs, a corrupt lawyer and finally the Belgian tax man.

Belgian media reported on 31 May 2021 that the authorities have approached the heirs of Ms de Spoelberch, herself an heiress to shares in the Artois brewery (which became Interbrew, then InBev and lastly AB-InBev) over outstanding inheritance taxes. Ms de Spoelberch’s estate at her death in 2008 was valued at nearly EUR 590 million, consisting mainly of AB-InBev shares.

The funny thing is that only thirteen years after the death of Viscountess Amicie de Spoelberch, her full title, the Belgian tax authorities discovered that some inheritance tax is due to them. At the time, the tax was paid in Luxembourg, probably for the simple reason that it would have been far lower than in Belgium.

Late-life love

As the newspaper Le Soir has the story, Ms de Spoelberch, at the age of 79, married the much younger Belgian Serb Luko Bailo in 2001. She then went on to adopt his two sons from a previous marriage, Alexis and Patrice. That made them her legal heirs. Mr Bailo, a certified engineer (according to his website) and a gambler who had several brushes with the law (according to Le Soir), died in 2004, after which she tried to disinherit her two adopted sons.

When she died in 2008, the sons continued to fight for their inheritance. Her fortune, consisting of millions of AB-InBev shares, was held in an offshore company in the famous tax haven of the British Virgin Islands. In 2010, a secret agreement was signed by all parties involved in Geneva, which put an end to the quarrels.

Who leaked the agreement?

Somehow Le Soir was able to have a look at the agreement. Per its report, Alexis and Patrice Bailo received EUR 589 million (then USD 712 million) in 2010, the rest went to the Roger de Spoelberch Foundation, Amicie’s brother. The agreement stated that the inheritance was to be paid in Luxembourg, not in Belgium.

Eleven years later, the Belgian taxman wants his share of the brothers’ windfall. The taxman thinks its claims have not lapsed yet. The Roger de Spoelberch Foundation, on the other hand, responded that it is not a debtor of the outstanding Belgian inheritance tax, and that it will contest the taxman in court.

Enter a corrupt lawyer

These are not the only battles over Ms de Spoelberch’s fortune. In 2015, it became known that the Belgian lawyer Farida Chorfi, who initially represented Alexis and Patrice Bailo against Ms de Spoelberch, was on trial in Luxembourg, after the brothers accused her of being behind the disappearance of USD 60 million worth of AB-InBev shares from a Luxembourg family vault in 2004. This was reported by Reuters.

Ms Chorfi had also tried to get a notary to approve a will, which would have made her heir to Ms de Spoelberch’s estate. The notary sensed that something was fishy and warned the viscountess, who lodged a complaint. The lawyer was convicted in Luxembourg for attempted fraud, fled, was arrested in Greece and extradited to Switzerland, where she was convicted of another money laundering offence. She was extradited to Luxembourg to serve her sentence.

So why is the Belgian taxman bringing the whole thing to light? Most likely the authority’s claims will not hold up in the courts. But at least by leaking the documents to the media the authorities were showing that they care about tax justice. The whole story just screams: “Wasn’t it time that the rich helped pay for the economic recovery after covid?”