CEO Tony Froggatt leaves Scottish & Newcastle

John Dunsmore appointed new Chief Executive.

It must be the season. Or why should so many brewers – Molson Coors, Carlsberg, Heineken, Warsteiner among them - part company with their chief personnel this month?

On Thursday 27 September 2007 the directors of Scottish & Newcastle (S&N) announced that John Dunsmore is to be appointed Chief Executive to succeed Tony Froggatt. The appointment follows an extensive succession review conducted by the full board.

John Dunsmore, 48, is at present S&N’s Managing Director, Western Europe. He will take up the position of Chief Executive from 1 November 2007. Tony Froggatt has agreed to remain available to the Chairman and the board for a further three months to ensure a smooth transition.

Although the City had been full of speculation that the departure of Tony Froggatt was imminent - Mr Froggatt had been expected to step down in the first half of next year, which would have been his fifth anniversary in charge of S&N, the maximum period the 59 year-old Australian originally said he would stay in the job - the expediency with which he was packed off and a successor was found surpised many.

Trust Sir Brian Stewart, the S&N Chairman, to act swiftly. Mr Froggatt departs at a turbulent time for the company, as tensions with its partner Carlsberg mount after repeated comments from the Danish lager giant that it is potentially interested in making a bid for the British group. Many observers believe that Mr Froggatt would have been positive towards a bid by Carlsberg. However, Sir Brian is said to favour S&N remaining independent. That’s why his choice of John Dunsmore, who ought to be considered a S&N ‘oldtimer’, despite having worked for many years as a banker, points in that direction.

Mr Dunsmore was appointed Managing Director Western Europe, which includes the UK & Ireland, France, Portugal, Finland, Belgium, Greece and the Venture Markets business, in May this year. With over 6,000 employees the net turnover for the area is GBP 3.0 billion with an operating profit of GBP 395 million. Between May 2002 and May 2007 he was Chairman and Managing Director of Scottish & Newcastle UK, the group’s largest division, representing 40 percent of the profits of S&N. Prior to joining S&N, he had worked for Deutsche Bank as an analyst.

S&N, a beer-led drinks business, ranks number seven by volume sales in the world’s top ten brewers, and has market leading positions in 15 countries across Europe and Asia, it says.

Its many beer brands include Baltika, Foster’s and Kronenbourg 1664, as well as John Smith’s and Strongbow in the United Kingdom and Kingfisher in India.

In August, the company said the achievement of this year’s targets will be ‘challenging’ due to adverse weather conditions, which affected sales in England and France.

The beer market in the UK declined by 5.2 percent during the first half which included a fall of 17 percent in June. S&N leads the beer market with a 27 percent share.

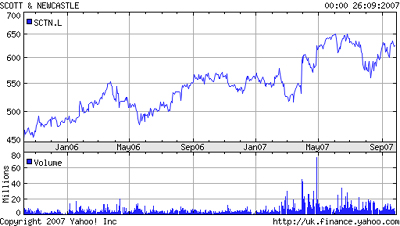

For several weeks now the British press has been more than concerned with S&N’s share price. Some commentators wondered why Carlsberg was playing fast and loose with S&N as reflected by the feverish ups and downs in S&N’s stock. ‘On the surface’, the Sunday Times wrote on 9 September 2007, ‘S&N enjoys a good commercial relationship with Carlsberg. It has a joint venture in Russia – BBH – that is doing well. But the Danish company appears to have other ideas. Over the course of the past few months the Chairman and departing CEO have made repeated comments about buying S&N and how attractive a deal would be. What is Carlsberg’s game? Is this clumsy public relations or a more sinister move? Either way, it is a strange way to woo a potential partner. If Carlsberg was a UK-listed company, the stock exchange would have demanded that it clarify its intentions. S&N should stand up and insist that it does so.’