Varying Tax Levels Leave Sour Taste to Beer - Beer - 2008

It is now 16 years since the declaration of Council Directive 92/83/EEC, where the European Union declared its intention to ‘harmonize the structure for excise duties on alcoholic beverages and alcohol contained in other products to ensure the establishment of the internal market’. A new report from Canadean ‘Beer Pricing in Europe - a taxing Question’ provides an in-depth study of the tax weight on beer, by individual markets and compared to other member states. The report exposes just how little progress has been made during this time and highlights the wide variance in tax burdens across the European Union.

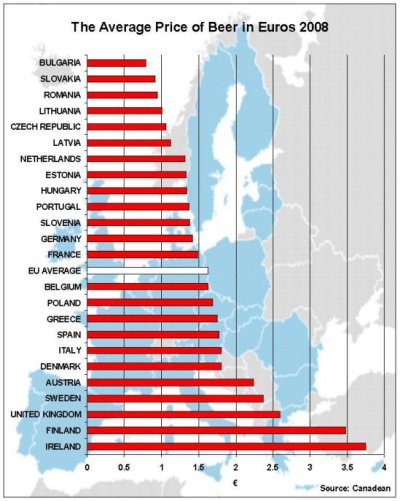

Europe remains divided between the ‘high taxation’ markets of Scandinavia and the British Isles and the ‘low taxation’ countries of Central and Eastern Europe and the Mediterranean. In Euros, the tax weight on a litre of mainstream beer (using the local standard beer abv %) varies from as low as EUR 0.21 in Bulgaria to as high as EUR 1.59 in Finland. Such broad variances in the tax weight lead to wide differences in prices that encourage consumers and smugglers to cross borders to capitalise on cheaper prices. In the member states affected by high levels of personal imports, there is considerable hardship put on their domestic brewers, reduced tax revenues and the undermining of their public health policy. Not only this, but it is a contradiction of the principle of a single market, a situation underlined by the fact that Swedish and Danish Brewers are producing beers to be traded over the border to their own domestic consumers at a lower price.

Using Canadean’s comprehensive price checks, the report exposes the wide variances in prices between individual markets, helping to explain the patterns of border trade seen across the Union. In the UK in 2007, the average price of beer in Euros sold in supermarkets was more than twice that of beer sold in French retail outlets, and even in 2008 when the pound weakened, prices are still 1.8 times higher in the UK. Germany is a popular destination for Swedes and this is easy to see why, when the average price of beer in Germany is 60% that of Sweden. Again it is clear to see why Finnish consumers travel to Estonia when average prices are less than 40% of those in Finland.

As the European Union is in the process of integrating more and more Eastern States into the Union, the need for debate and action would seem to be more appropriate than ever. Even Germany which has historically prospered from border trade activity has begun to see a trickle of its own consumers cross into the Czech Republic to buy beer. Compromise continues to seem distant and it is very unlikely that the high tax nations will lower their taxes to bring them into line with the low taxation nations; indeed Finland, Sweden and the UK have all increased their tax rates in 2008 to further amplify the differences.

“Beer Pricing in Europe – A Taxing Question” is a new special-interest report published by Canadean containing an overview of the tax systems in each EU member state as well as a wealth of data on average beer prices, excise duty and VAT rates, and the total tax burden. For further information about this report, please contact Kevin Baker on +44 (0)1256 394220, or email .

Source

BRAUWELT International 2009