West European Beer Sales in the First Half of 2009

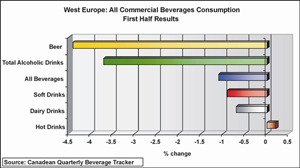

Beer sales have been hit hard as consumers across the region tighten their purse strings by shunning bars, pubs and restaurants. ‘Cocooning’ a term not used since the downturn of the early 1990’s has been resurrected to describe the trend for drinkers to stay at home to entertain family and friends rather than eat out or go to a bar to socialize. In some markets smoking bans and increased duty have contributed to amplify the level of abstinence. Nowhere is this best illustrated than the Netherlands where an excise duty increase and a smoking ban in cafés has triggered a considerable nine percent decline in beer sales in the first half of 2009.

In contrast soft drinks volumes have held up relatively well. Like beer, the recession has impacted on sales in the Horeca channel but much of this volume has shifted to the supermarkets. Beer in particular has been unable to capitalise on any switch from on to off premise; people drink less beer when they do not go out so regularly. It is this factor that is believed to have helped the hot drink category to edge forward as people stay at home and drink tea and coffee instead. Hot drinks are also a very economical form of refreshment and have often fared well during tough financial periods.

Soft drinks volume may be holding up but this is not the case in value terms as consumers shrink their household budgets. Canadean consultants on the ground report that private label is outperforming branded products in every market with the exception of Belgium, Finland, Sweden and Greece. Hard discounters are flourishing and are broadening their net across the region; even the Canary Islands are poised to see the opening of a hard discount outlet.

The third quarter is the most influential on commercial beverage sales and the performance in July, August and September will dictate the overall performance of the year. Hot temperatures in July and August or an Indian summer in September could make the volume performance more respectable.

Canadean analysts anticipate a marginal improvement in the volume performance of the commercial beverage market as the comparable period; the second half of 2008 saw the eye of the financial storm. Beer sales are predicted to end the year three percent down, while soft drinks should finish the year only slightly down. Overall the decline in beverage consumption will fall to well below one percent.

Source

BRAUWELT International 2009