Carlsberg Germany has a new CEO and a new strategy

Isn’t it a lovely German euphemism: “gesundschrumpfen“. It translates as “shrinking yourself healthy.” Struggling companies employ it when they have to admit defeat and see no other way out than to downsize their operations in a major way. Carlsberg Germany is a case in point. Last year it sold its so-called Fighter Brand Unit including its Feldschlößchen Brewery in Braunschweig, announced that it was looking for a partner to help run its Feldschlößchen Brewery in Dresden more efficiently and began trimming down its brand portfolio to five brands only. Last but not least, it decided to limit its business to the northern part of Germany, to which end it formed a distribution joint venture – Nordic – with distributor Nordmann.

Last year, Carlsberg Germany allegedly sold 5.2 million hl. Based on 2008 output figures it ranked seventh among Germany’s major brewing groups. In 2008 Radeberger topped the list with 13.5 million hl sold, followed by InBev (13.5 mio hl), Bitburger (7.4 mio hl), BHI - the Heineken/Paulaner joint venture (7.4 mio hl), the cheap beer producer Oettinger (7.1 mio hl) and Krombacher (5.7 mio hl).

What may have surprised many – Carlsberg Germany now lists Lübzer, a regional brand in the north, as its “drive brand”. The Carlsberg brand, Duckstein and Astra are “support brands”, whereas the big seller Holsten has been reduced to a “maintenance brand”.

Pity, but many still remember that when Carlsberg bought Germany’s Holsten Group in 2004 and became Germany’s fifth largest brewer, Carlsberg’s then CEO Nils S. Andersen said that he would turn Holsten into a national premium brand.

Well, Mr Andersen has since moved on to bigger things – as CEO of shipping company AP Moeller-Maersk – and in Copenhagen they most likely shrug their shoulders and say: “what do we care about the rubbish he uttered six years ago?”

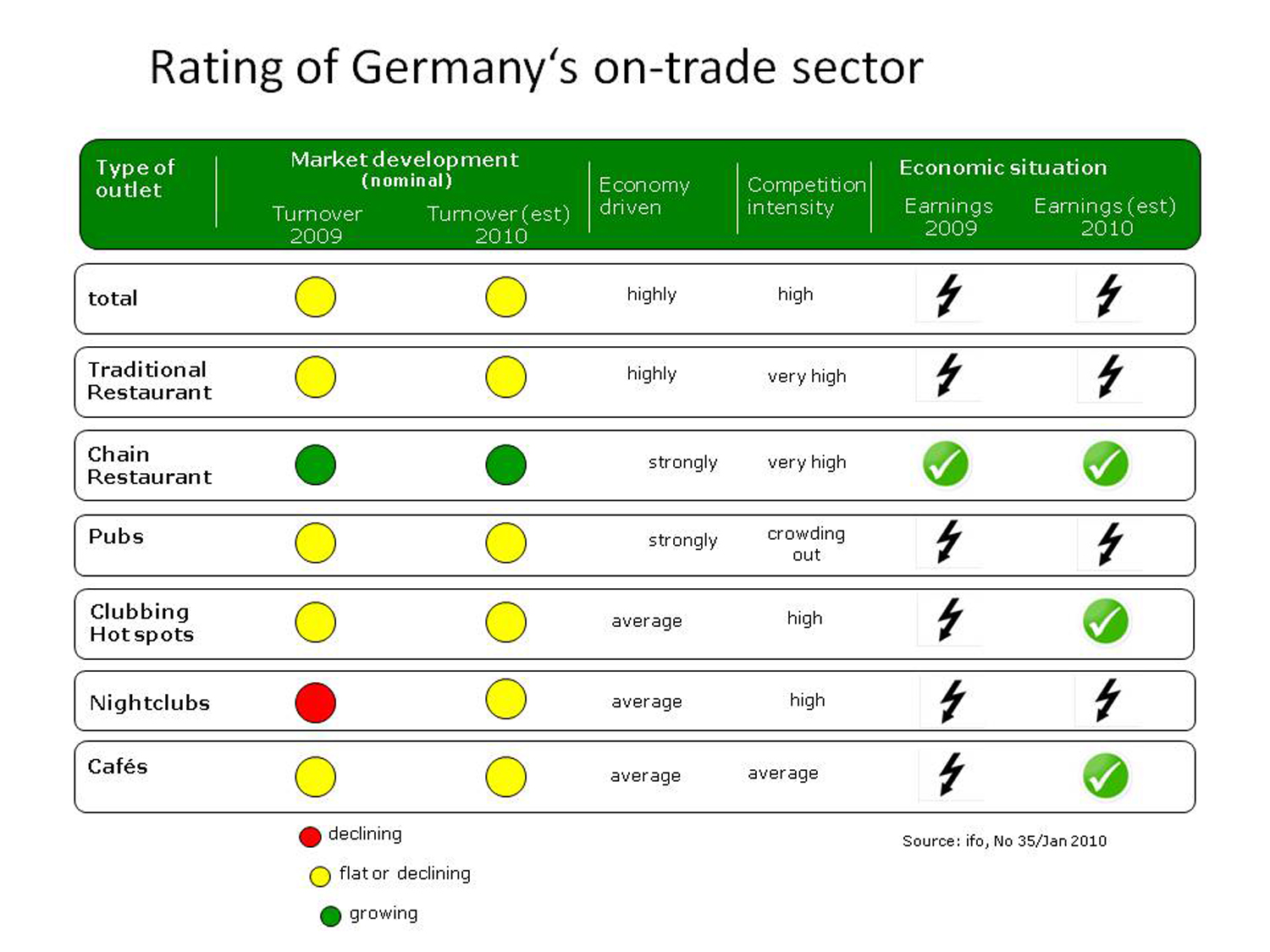

Alas, Carlsberg Germany’s efforts at shrinking itself healthy are not limited to its brand portfolio. Probably, as a first move towards downsizing its distribution network, Carlsberg Germany also said it would review its on-trade customer base in order to henceforth concentrate on better-performing on-trade outlets in its core market.