Scottish whisky industry cheers rising demand

Single malts only account for just over 6 percent of 2009’s 94.4 million 12-bottle case scotch market by volume, but the malt industry has grown volumes by 23 percent in the 2005-2009 five-year period compared to 10 percent for the whole industry.

Single malts come from Scotland’s 102 malt distilleries scattered mainly across its highlands and islands, while large blended brands such as Johnnie Walker, Dewar’s and Ballantine’s are made up of around one third malt and two thirds industrially produced grain whisky.

For almost 20 years it seemed as if Scotland’s whisky makers were stuck at the back of the bar. While whisky volumes were almost flat, vodka production rose by 3.5 percent a year for 20 years. The reason? Scotch whisky, even basic blends, has to mature in a cask for at least three years, while vodka can be distilled, bottled, shipped and drunk within a week. As demand flagged, many smaller distilleries closed or were bought by international drinks groups.

That led to a change of strategy: namely a move upmarket, also known as “premiumisation”.

This strategy is now paying off: Scotch exports have risen by over 40 percent in value since 2000. Despite a global slump, records were set last year: the volume of exports (90 percent of production) rose by 4 percent to 1.1 billion bottles worth GBP 3.1 billion (EUR 3.8 billion).

In effect, the distilling industry has contributed significantly to the Scottish economy and continues to do so, albeit without creating any new jobs, much needed though they are. Scotland’s unemployment rate has risen to 8.0 percent (June 2010), slightly above the rate for the UK as a whole, where this is 7.9 percent.

While in 2009 Diageo, the world’s biggest drinks group, which dominates whisky sales with brands such as Johnnie Walker, J&B and Lagavulin, opened a GBP 40 million distillery near Elgin, the first new one in Scotland for 30 years, it also announced in June 2009 that it planned to shut its Johnnie Walker bottling plant in Kilmarnock and its Port Dundas grain distillery in Glasgow, threatening 900 jobs (or 10 percent of its workforce).

France’s Pernod Ricard, the world’s number two in drink with brands such as Chivas Regal, Ballantines and Glenlivet, in June this year unveiled a GBP 10 million modernisation plan to boost production of Glenlivet by 75 percent. It hopes to rival the world’s bestselling malt, Glenfiddich, made by William Grant, still an independent firm.

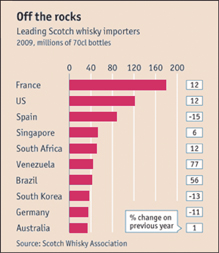

Although France, America and Spain are the largest Scotch whisky markets, the biggest growth is coming from South American countries, such as Brazil and Venezuela, where premium blends are appealing to affluent consumers. Much of the investment in boosting volume is to build up reserves in the expectation that something similar will happen in India and China. At present international spirits such as whisky and brandy account for less than 1 percent of the Chinese market.

The Chinese are getting a taste for whisky, but the challenge for Scotland’s producers will be to ensure that they choose Scotch whisky – rather than American bourbon!

Authors

Ina Verstl

Source

BRAUWELT International 2010