Like a jumble sale

Carolans is an Irish cream liqueur with a total volume above 600,000 nine-litre cases sold in more than 60 markets. 60 percent of the brand’s sales are in the United States. The same could be said for Frangelico, a premium Italian hazelnut liqueur. The U.S. accounts for 50 percent of the brand’s sales.

Irish Mist is a liqueur made from a blend of Irish whiskey, honey and natural aromatic spices and sold in more than 40 markets.

These brands were formerly owned by Ireland’s C&C Group (Magners cider) which earlier this year agreed to sell its spirits and liqueurs to William Grant for EUR 300 million. While C&C branched out into beer and took over the Tennent’s lager brand from AB-InBev, William Grant decided to keep brands like Tullamore Dew Irish whiskey and others from the C&C purchase, but sold the liqueurs on to Campari.

What did we say? It’s like a big jumble sale in the drinks industry.

The deal will take Campari’s net debt to 2.5 times its EBITDA, which is well below the 4.25 times limit on its banking covenants. Campari declined to comment what its credit line was for further deals.

At EUR 129 million, Campari is paying 7.5 times 2009 EBITDA for the brands as compared to an industry average of 17 times and Mr Kunze-Concewitz said it will strengthen Campari in the U.S. spirits market, the biggest and most profitable in the world.

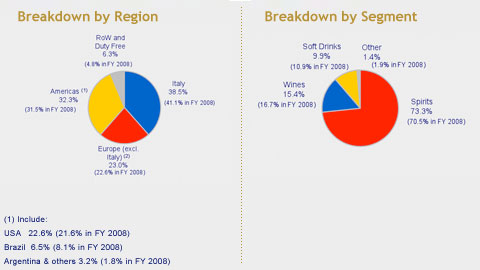

Gruppo Campari is an unashamed multi-beverage company with stakes in soft drinks, wine and spirits. It has made 17 acquisitions in the last 15 years, the biggest being last year’s USD 575 million purchase of the Wild Turkey Kentucky bourbon whiskey brand.

In its financial year 2009 (ended 31 December 2009) Gruppo Campari had total net sales of EUR 1.0 billion, an EBITDA of EUR 265.1 million and a net profit of EUR 137.1 million, up 8.3 percent on 2008.

Among the world’s drinks groups, Campari ranks sixth in market capitalisation behind Diageo (USD 42 billion), Pernod Ricard (USD 22 billion), privately-owned Bacardi, Brown-Forman (USD 8.5 billion) and Fortune Brands (USD 7.4 billion).

Campari, which is 51 percent owned by the Garavoglia family, has a market capitalisation of EUR 2.5 billion.

Mr Kunze-Concewitz, despite his bullish attitude, will have quite some catching-up to do before Campari gets near the likes of Fortune Brands (Jim Beam) or Brown-Forman (Jack Daniel’s).