Diageo spoilt for choice

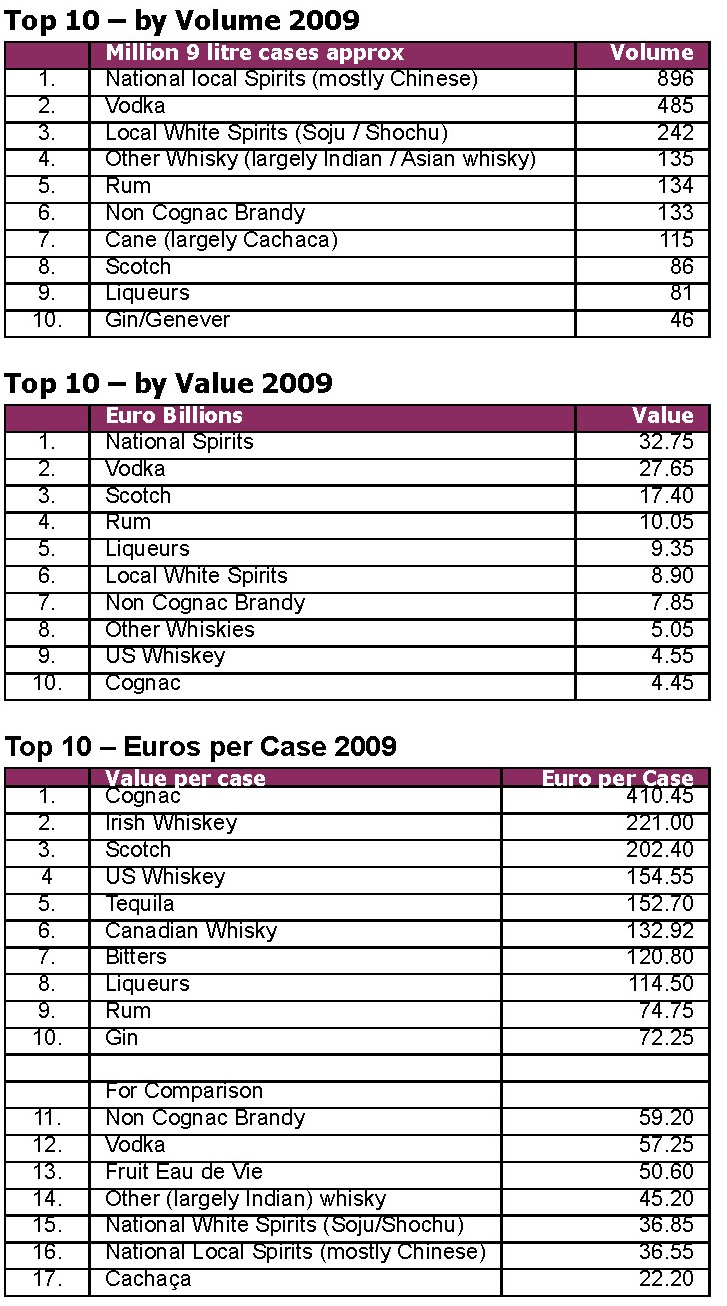

World dominance in spirits is a far cry from beer. Research company IWSR ranks Diageo as the world’s number one drinks company with a volume share of 3.8 percent (11.3% in value), followed by Pernod Ricard (3.7 percent of volume/8.9 percent of value) and India’s UB/UBL (3.7 percent of volume and 2.4 percent of value). Compared with AB-InBev (19 percent of global volume but 34 percent of global profit) that’s not exactly peanuts, but little more.

Although the world’s media in recent years has focused on deals in western spirits brands, China happens to be the place where the action is. China isn’t only the world’s number one market for beer, it is also number one for spirits – both in volume and value.

According to IWSR, total value sales (retail sales price) in China in 2009 were higher than in the U.S. for the first time: EUR 31.25 billion for China versus EUR 23.75 billion for the U.S.

It’s hardly surprising that Diageo and Pernod Ricard have been trying to clinch deals in China, whose market concentration in local spirits is low, with the top 10 brands accounting for only around 25 percent of total industry revenue in 2009.

However, following the authorities’ 2009 rejection of Coca- Cola’s bid for China Huiyuan Juice Group, multinationals need to tread carefully when making overtures to large Chinese brands.

In contrast, the Indian drinks market seems fairly consolidated with United Spirits (controlled by the UB Group) enjoying a 60 percent market share, equivalent to 73 million cases in 2008. United Spirits’ dominance is to be found in every category and geography in that vast market.

In early 2009 it was reported that the UB Group wants to sell a minority stake (15 percent) in United Spirits. Diageo has been in discussions for a long time. The investment would not only set the group on the path of potentially acquiring the rest of United Spirits one day; it would also provide a platform for Diageo’s own imported premium brands, especially Johnnie Walker as India is still mostly a whisky market.

One question mark, however, is how such a partnership would sit alongside Diageo’s 50:50 joint venture with Radico Khaitan, the number two drinks company in India with a 10 percent market share.

Moreover, any western buyer should be forewarned by Heineken’s experiences with UB’s business practices. When Heineken, along with Carlsberg, acquired UK- based Scottish & Newcastle (S&N), it obtained a 37 per cent stake in UB.

However, UB didn’t allow the Dutch to nominate members on its board as Heineken also had a stake in APB India, a joint venture with Jaipuria which was directly competing with UBL. In 2009 Jaipuria exited the joint venture by selling their stake to Heineken which cleared the path for UB and Heineken to enter into an agreement.

An outside candidate for United Spirits’ 15 percent stake is Suntory. Unlike the other Japanese beer giants, Asahi and Kirin, Suntory has a significant domestic spirits business already. Also, Suntory might be culturally more comfortable with a minority strategic stake in United Spirits than some of the other bidders.

India and China are expected to be the two fastest-growing markets for spirits globally and India will overtake Russia to become the second-largest spirits market globally in 2013, at least in registered taxed sales.

This goes to show that Diageo is in a quandary as to where to put its investment money.