Heineken received thumbs down after forecasting flat 2011 profits

Which planet do investors live on that they expect brewers to keep on growing bigger and ever more profitable while the world economy is entering a dangerous new phase? Shares in Heineken were sent spiralling down after Europe’s top brewer warned that demand for its beer in Europe and the U.S. will remain "challenging" this year.

Bad enough that the brewer on 24 August 2011 revealed weaker-than-expected net profits of EUR 605 million (USD 872 million) for the first half of the year.

What brought investors close to a nervous breakdown was that Heineken said its full-year profit is unlikely to grow over last year. So-called organic adjusted net income for 2011 will be “broadly in line” with last year, the Amsterdam-based company reported.

Investors had better stop hand-wringing and moaning and listen to CEO Jean-Francois van Boxmeer telling them what Heineken is doing to combat the long-term consumption decline in Europe. True, these efforts require investments and they will not bear fruit in the short-term. But the alternative is clearly to cost-cut yourself into extinction. And how clever is that?

Heineken gets about 45 percent of its sales and 36 percent of its EBIT from western Europe. That is why BRAUWELT International was intrigued to hear of Heineken’s emerging global brands portfolio. While before it was always Heineken, Heineken and Heineken, the new portfolio is to include the Heineken brand, Strongbow cider and Desperados, a tequila beer.

This year Heineken has launched Desperados in 10 new markets, mostly in Europe. It has also taken a Radler into countries like Poland, Slovakia and Croatia and it has rejuvenated the Foster’s brand in the UK through brand extensions and new glassware. All these efforts are to attract consumer interest and grow value in western Europe’s highly mature markets.

By creating a global brands platform, Heineken is only doing what AB-InBev has already done. But BRAUWELT International says: “better late than never.” Or how should Heineken steer retailers away from price discussions if they don’t make the supermarkets an offer they cannot refuse? In Europe, the supermarket chains are already calling the shots and their power will only increase if the on-trade sector continues to deteriorate.

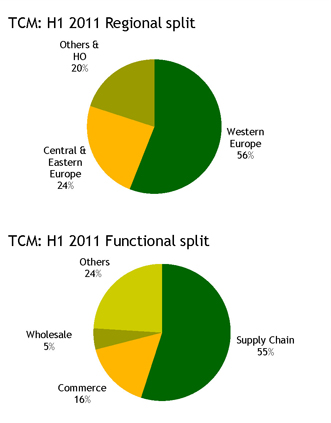

Heineken announced that it is going to launch another three-year cost-cutting initiative as of 2012 when the current Total Cost Management programme (which has helped them save EUR 517 million since the start of 2009) expires.

Spectacular brewery closures (over 40 in the past decade) are off the agenda. But once Heineken has realised the announced changes to its logistics, admin and IT structures across Europe, head count will have come down significantly too. As Mr van Boxmeer said: These productivity improvements will be “less brutal [than brewery closures] but equally effective” – as concerns costs.

“A company has to continue to address its productivity issues on an ongoing basis,” Mr van Boxmeer said. “If in the past we’ve been devoting a lot of attention to our infrastructure in terms of brewing and overheads, going forward we’ll devote a lot of attention to our purchasing activity.”

As to managing its Heineken brand, which has been growing volumes for the past five years and at 22.6 percent is the leading brand in the international premium segment (it’s twice as big as its next competitor Corona Extra), the brewer has finally centralised its marketing and advertising efforts as well (after the look of the label and the recipe) by cutting the number of agencies down to three from the previous 27 and rolled out a global campaign like the new one “Open your world”. That way Heineken hopes to turn its eponymous brand into a truly global one from a merely international one (sold in 179 countries) previously.

During the first half Heineken managed to increase beer volumes in western Europe (although sales in Greece were abysmal) and all other regions except for the Americas. Here sales slid 2.4 percent. The company lost market share in Mexico and volumes in the U.S., where its “Dutch portfolio” (Heineken and Amstel) declined 5 percent, Mr. Van Boxmeer said.