Salmon is it

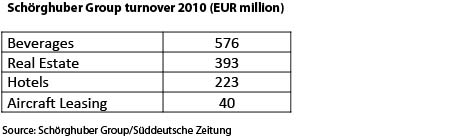

The news rocked the earth. Schörghuber Group, Heineken’s joint venture partner in Germany, is going to invest in salmon farming in Chile. But what about the new Paulaner brewery project? No further details. In an exclusive with Germany’s leading national daily “Süddeutsche Zeitung” on 13 September 2011, the heiress to the EUR 1.2 billion turnover Schörghuber Group, Alexandra Schörghuber, only reiterated what has been common knowledge for several months: that they will make a decision on whether to build a new Paulaner brewery in Munich before the end of the year.

In a rare interview Mrs Schörghuber, who became heiress to the privately-owned Schörghuber Group (with interests ranging from brewing and real estate development to hotels and aircraft leasing) following the sudden death of her husband in 2008, spoke at length about salmon farming in Chile and the great potential the fish held in markets like Japan and the United States.

Salmon farming with a turnover of allegedly EUR 100 million had previously been a Schörghuber family venture kept separate from the Schörghuber Group. It is now to become part of the group in order to double in size over the next four to five years. Some of the investment required for the salmon business’ expansion is to come from selling off what is left of Schörghuber’s aircraft leasing unit, which was slated for discontinuation three years ago.

So far so old news.

When pressed for an answer by the interviewers if Schörghuber will build a new Paulaner brewery on the outskirts of Munich, thus abandoning its inner city site, Mrs Schörghuber and her CEO Klaus Naeve repeated what Schörghuber had already told media in June this year: that a decision to relocate the brewery or merely its distribution centre would be taken before the end of the year.

To the interviewers’ remark that either scheme will require a huge investment, Mr Naeve replied that they had put all their arguments into a 300-page presentation which they would discuss with their partner Heineken.

Schörghuber and Heineken set up a beer joint venture called Brau Holding International (BHI) in 2001, which combines interests in Paulaner, Kulmbacher and a host of smaller breweries in southern Germany.

Through its 49.9 percent stake in BHI, Heineken has an indirect stake in Paulaner of slightly under 25 percent. No doubt Heineken will want to have a big say as they might have to chime in on the investment.

The interviewers argued that Heineken could view the investment in a new brewery less emotionally than Schörghuber, whose headquarters are in Munich. In 2010, their joint venture only reaped a profit of EUR 22 million, up from EUR 10 million in 2009, it was reported.

Here Mr Naeve said something highly interesting. He called Heineken “very emotional”, like Schörghuber Group, and unlike the local competitor AB-InBev, the owner of the Spaten-Löwenbräu brewery in Munich, whom he described as “finance-driven”.

Although Mr Naeve had to concede that AB-InBev did a good job, he thought that Schörghuber’s strategy in Germany (on which he did not elaborate) would prove more successful in the long-term.

Strange that Mr Naeve should say such a thing. It’s not customary for companies to comment on their competitors in public. It is even less accepted to do so in an implicitly derogatory fashion. Besides, we are not so sure that Mr Naeve’s distinction between Heineken’s and AB-InBev’s approach to doing business stands to reason, flattering as it may seem. Heineken is a stock market-listed brewer like AB-InBev and has to justify any investment to its shareholders.

This is where we have our doubts. No matter how you look at it, the fact remains that BHI is a small player in the German beer market.

According to Dr Kelch’s market research for Brauwelt, BHI ranked as Germany’s number six brewing group in 2010 with beer sales totalling 5.3 million hl, of which 4.5 million hl were sold domestically. That gives BHI a share of 5 percent of domestic beer consumption. Its main seller is Paulaner, which ranked 8th among Germany’s beer brands in 2010.

Moreover, the interviewers seemed to have some doubts as to Schörghuber’s financial clout too. The Schörghuber Group recorded losses in 2008 and 2009 and earned a small profit of EUR 60 million in 2010.

However, Mr Naeve was adamant that the group would reap “very good” profits in 2011, albeit not at 2010 levels.

As we have written previously on the issue: don’t hold your breath.