Despite protests parliament approves beer excise bill

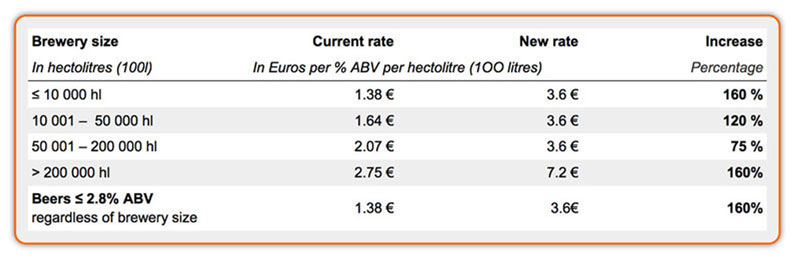

All protests were in vain: the French parliament on 3 December 2012 approved a bill to hike French beer tax by a massive 160 percent. Despite best efforts by the French Senate, twice sending the law back to the Parliament with a modest amendment to raise excise by only 120 percent – the law was finally passed without further modifications and will come into effect in January 2013.

The measure will hit all brewers and all beers, with only a slightly lower increase for some medium-sized breweries. Equally affected will be brewers exporting to France as one in three beers consumed in France is imported from Belgium, Germany, the Netherlands and the UK.

Pierre-Olivier Bergeron, Secretary General of The brewers of Europe, commented: "What makes this even more galling is that beer has been singled out amongst the other alcoholic beverages – despite beer only representing 16 percent of the French drink market and per capita beer consumption in France already being the second lowest in the EU."

Per capita consumption of beer in France stood at 29 litres in 2011.

The Brewers of Europe say that, while the 160 percent tax hike may increase the EUR 337 million in excise duties that beer in France generates each year, it could put at risk total government revenues of EUR 2.6 billion from the production and sale of beer – VAT, excise duties, social security contributions and income taxes across the supply and value chain.

Ultimately, the government may earn more in excise but lose even more in total.

No wonder that the hospitality sector has been fighting the measure hand in hand with the brewers throughout the autumn. In total around 65,000 jobs are generated by beer in France, 70 percent of which are in the hospitality sector. Beer represents over a third of revenues for cafés and brasseries.

Many fear that the beer market in France could decline by up to 15 percent following the implementation of the excise hike. The tax is expected to lead to a EUR 0.25 to EUR 0.40 increase in the price of a small beer.

In keeping with its previous – dare will call it condescending? – stance on the matter of the French excise hike, the British Beer & Pub Association, commented:

"Lower strength drinks like beer shouldn’t be singled out for excessive tax hikes. However, it is still worth pointing out that even with this huge rise, UK beer tax is still more than three times higher than in France – around GBP 0.39 per pint. And there must be more than a degree of Schadenfreude in Germany as the UK rate is now an astonishing 13 times higher than theirs."

There is no denying that British brewers and consumers are hit even harder by beer excise hikes. Under the UK Government’s automatic escalator policy, beer tax is set to rise even higher, despite increasing by 42 percent since March 2008.

Could it be that British Brewers feel miffed that no industry body in the rest of Europe leaps up and down on their behalf, as happened now in the case of France?