Down down down

Whoever put out the estimate how much Heineken’s Finnish subsidiary Hartwall could fetch if sold seems highly optimistic. In early February 2013 the UK’s Sunday Times newspaper reported that Dutch brewer Heineken was seeking to sell Hartwall, the Finnish arm of the former Scottish & Newcastle brewing group it bought in 2008, for about GBP 500 million pounds (EUR 590 million).

According to the website largestcompanies.com, Hartwall’s turnover in 2010 was EUR 322 million (USD 425 million). Its rival Sinebrychoff, which is owned by Carlsberg, achieved slightly over EUR 350 million while Olvi managed EUR 285 million. The three companies dominate the Finnish alcohol and non-alcoholic beverages industry.

It’s hard to make an educated guess on Hartwall’s margins as Heineken does not release country-by-country financials. Since Heineken closed Hartwall’s northernmost Lapin Kulta Brewery in 2010 and concentrated operations in Lahti, profitability must have improved, but whether this was enough for Hartwall to reach Heineken’s Western European average of 12.4 percent (EBIT margin) in 2012 we are not sure.

From what we hear, margins in the Finnish beer business are much lower than that, while they would be higher in Hartwall’s other segments such as ciders and long drinks.

If Olvi’s reported margins are anything to go by, we at BRAUWELT International would put Hartwall’s EBITDA margin at perhaps 17 percent and its EBIT margin at 11 percent, thus below Heineken’s EBIT margin for the region.

Provided our estimates are not too far off the mark, The Sunday Times’ undisclosed source thinks Hartwall could be valued at 11 times EBITDA. That’s a lot. The most recent deal in the brewing industry – AB-InBev’s and Constellation’s – represents an EBITDA multiple of 9.

Heineken was quick to deny the allegation that it was seeking a buyer for Hartwall, saying that it was only conducting a business review.

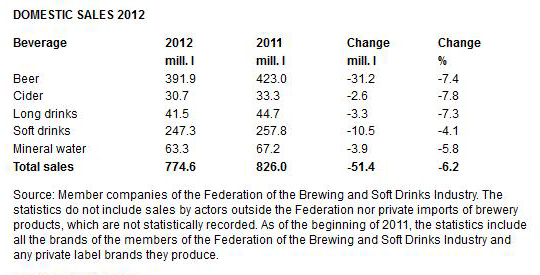

No doubt, the review will be very sobering. As the Federation of the Finnish Brewing and Soft Drinks Industry, Panimoliitto, reported on 21 February 2013, brewers’ volumes sales collapsed in 2012, with a loss of EUR 50 million (USD 66 million) in taxes to the Finnish government.

There were volume losses recorded in all beverage categories, but beer and cider sales were worst affected, dropping 7.4 percent and 7.8 percent respectively. Such a dramatic fall in sales has never been seen before, Panimoliitto reported.

That the government lost EUR 50 million in taxes from beverage producers, it only has itself to blame for. Excise on beer, cider and long drinks was increased by 15 percent at the beginning of 2012, which makes Finland’s beer tax 53 percent higher than Sweden’s. It is also the highest in the EU, and no less than five times higher than neighbouring Estonia’s. Small wonder Finns have taken to buying booze in Estonia from where they take it back home on the ferries.

In addition to tax increases, sales were hampered by a rainy summer and stores stocking up in 2011 before the tax increases. The consumption of alcoholic beverages has been on the decline for five years running, Panimoliitto pointed out.

“The brewing industry has been hard-pressed by the tax increases of recent years. Last year, an exceptional fall in sales was seen simultaneously in all beverage categories. When devising tax solutions, decision-makers should carefully evaluate whether tax increases will endanger jobs in the industry. The brewing industry provides direct employment for 2,300 and indirect employment for 30,000 people in Finland”, Elina Ussa, Managing Director of the Federation of the Brewing and Soft Drinks Industry, said.

In light of these developments, not only the Finns are waiting for the outcome of Heineken’s business review.