AB-InBev’s uphill struggle with Corona

They need to be bullish, don’t they? Although their USD 20 billion transaction with Mexico’s brewer Modelo is far from cut and dried, AB-InBev said on 27 February 2013 “we remain excited about the potential to grow the domestic Mexican business and the Modelo brands outside of Mexico and the United States”.

As we all know, potential is not the same as actual reality. All of us may have the potential to win the Nobel prize, but how likely is it that anyone is going to give it to us?

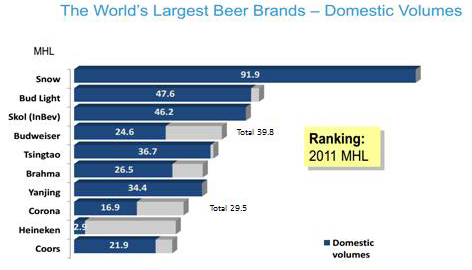

Same with the Corona brand’s potential. While it’s true that the Corona brand is the leader in Mexico with almost two times the volume of the second largest brand, it is still a piddling little brand amongst the global beer brands.

Consider this. In 2011, 29.5 million hl of Corona were sold globally, says Canadean, a market research company. If you deduct domestic volumes (16.9 million hl), that leaves an export volume of 12.6 million hl. Not bad. However, you need to bear in mind that of these 12.6 million hl, over 8.4 million hl of Corona were sold in the U.S. alone, according to estimates by Beerinsights.com. That left 4.2 million hl in total volumes for the rest of the world, or more precisely 38 countries in which Corona is currently sold.

The sheer number of 38 countries may appear impressive considering that 45 countries around the world account for well over 95 percent of the global beer profit pool. Yet, prodding further, how significant are these countries in terms of total beer profits? Here data compiled by Marakon, a consultancy firm, in 2012 makes fascinating reading.

According to Marakon’s research, there are only 13 countries where Corona earns over EUR 50 million in revenues and only nine countries where Corona sells over 100,000 hl. Now compare that with the Heineken brand which is available in 172 countries: There are 32 countries which bring in over EUR 50 million each in revenues and over 37 countries where Heineken volumes are in excess of 100,000 hl.

Why Marakon decided to only rank countries where global beer brands sell more than 100,000 hl? Well, if you claim that your brand has visibility and, by logical extension, credibility in the market, perhaps 100,000 hl is really the cut-off rate. In Germany, for example, where Corona is imported and distributed by domestic brewer Radeberger, the brand, as I see it, certainly has garnered consumer awareness. But with a sales volume of an estimated 45,000 hl it has hardly achieved what could be called visibility.

AB-InBev would probably argue that exactly therein lies Corona’s great potential.

Possibly. Nevertheless, at the moment the Corona brand’s true global footprint in terms of volumes puts it almost on par with SABMiller’s Peroni brand. And this brand, despite SABMiller’s decade-long efforts at taking it international, does not even rank among Marakon’s top 10 global beer brands.

Of course, AB-InBev will eventually give Corona the Budweiser treatment and take it to markets where they call the shots. In 2012, for the first time, more than half of Budweiser’s volume – 51 percent – was sold in about 80 countries outside of the United States. In 2009, only 28 percent of Budweiser’s sales were abroad. To speed up Corona’s global roll-out they might even decide to brew it locally in markets like Latin America’s, where consumers don’t really care if a high-end beer is a genuine import or not.

How quickly AB-InBev will reach their targets for Corona remains to be seen as Corona might require a bit more explaining to consumers than Budweiser, which is after all the “American Dream in a bottle”, according to Carlos Brito, CEO of AB-InBev. Alas, to many, Corona is still only a slice of lime in a bottle.

But trust AB-InBev not to shy away from a challenge.