Beer cartel scandal just got a lot bigger

How daft is this? Why would Germany's major brewers risk being fined for cartel shenanigans and price fixing while they put good money into retailers' grubby hands so that they can sell even more of their beers on super-saver offers? Why indeed?

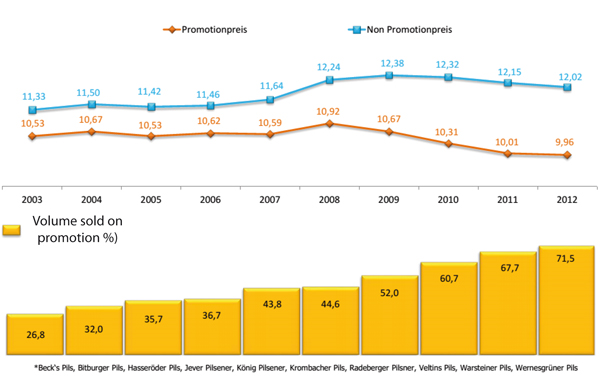

Fact is that, over the past decade, the volume of beer sold on offer for less than EUR 10.00/USD 13.30 per crate (that's 20 bottles x 0.5 litre) by major German pils brands has risen from 27 percent to 71.5 percent (2012) says GfK, a market research outfit.

All of Germany's major beer brands have been affected by the retailers hyperactively dumping prices. At any time you can find a crate of a major beer brand for EUR 8.99/USD 12.00 or less. The best deal so far (December 2011) was a crate of Veltins beer plus some batteries plus a sixpack at a supermarket for EUR 12, which translates into EUR 4.51/USD 6.00 for the beer itself.

Not that this kind of promotional activity came cheap to the brewers. Consider it a given that the retailers will not sacrifice their own margins. Therefore, it's highly likely - although I have no proof for this - that the brewers, one way or another, subsidised these special offers. As one insider told me, contracts between the supermarket chains and their suppliers may include 50 different kinds of kick-backs, which the retailers can use as they deem fit.

Because German brewers have long put volume over value, beer retail prices are nominally as low as they were 20 years ago. If adjusted for inflation and VAT, they have almost halved during this period.

I cannot think of any market, except perhaps for a few emerging markets, where beer is as cheap as in Germany's off-premise channel.

Nevertheless, ultra-low beer prices have not stemmed the decline in German beer consumption. Between 1993 and 2012 beer consumption dropped 25 million hl or 23 percent. Which makes you wonder: has it declined despite these low prices or perhaps because of those super deals? Beer may be cheap and cheerful but that's not the same as saying that it is still aspirational.

All in all, German brewers, for twenty years have had to contend with twice reduced returns: in margins and volumes. The sad conclusion is that this has been all of their own doing.

Still, it's hard to fathom what consumers will make of the latest scandal spread by the magazine Focus this week, quoting from the Cartel Office's as yet unpublished report, that major German brewers, with a combined market share of 50 percent, have been engaged in illegal price fixings "for decades".

Previous leaks had indicated that the Cartel Office was only looking into shady price agreements in the years 2006 and 2008.

The investigation has been on-going since 2011 and in March 2013 the Cartel Office said that it will be completed this year.

How Focus has obtained a copy of this report - or who from - we will probably never find out. But according to Focus, it shows that eleven or so major brewers have been involved in illegal price fixing for 24 major brands. Allegedly, agreements were conducted in such a way that producers of premium beer brands met in person or discussed price hikes over the phone. These plans were then passed on to smaller brewers. "Often this led to a general beer price hike", Veltin's executive Volker Kuhl reportedly said in his testimonial to the Cartel Office in January this year.

Another brewer - Bitburger - also gave testimony to the anti-trust watchdog. Thanks to their testimonies, Veltins and Bitburger are likely to receive reduced fines if the watchdogs have actually found solid proof of illegal goings-on. One brewer to go scot-free is AB-InBev. In July this year, AB-InBev said that they had turned themselves prime witness in the Cartel Office's investigation, which means that they will not be fined even if found guilty.

Provided all the reported allegations are true, German brewers deserve to be fined. Not only because they acted against the law. Above all, they deserve to be fined for their blatant stupidity.

Let's be frank, if I were to set up a cartel, I would only do it with two of my competitors, not with ten. And I would only choose my most trustworthy competitors to minimise the risk of leaks. What is more, I would never involve AB-InBev because when push comes to shove they will immediately turn whistleblower. Readers will remember that in 2007 the European Commission fined Dutch brewers Heineken, Grolsch and Bavaria a total of EUR 274 million for operating a cartel on the beer market in the Netherlands. The then InBev received no fines as they provided decisive information about the cartel under the Commission’s leniency programme.

As to the total fines: a widely reported estimate is EUR 100 million (USD 130 million) or more. I am not a Cartel Office insider so I have no means to verify this estimate. But some pundits say that this could very well be true. Given that major brewers' marketing budgets range anywhere between EUR 10 million and EUR 70 million, a fine of let's say EUR 10 million each will mean a serious punishment.

What lessons are we to draw from the above? A German brewer once told me: "Price competition is a growth drug in young and hungry emerging markets - but it's like assisted suicide in mature markets such as Germany. If sales volumes do not grow, the value of the brand has to grow. Anyone who does not understand this and does not draw the necessary conclusions from this and raises prices will not survive." If German brewers had not worshipped the "Volume God" they would not have needed a cartel to raise prices - all the while counteracting it through increased promotional activity.

This underlines what Prof Peter Kruse, an expert in organisational psychology at the University of Bremen, once said of the German beverage industry: "Industry intelligence is reflected in the difference between the selling price of the manufacturer and the retail price. In this respect, the German beverage industry seems to have the least systemic intelligence."

Rather than set up an illegal cartel, German brewers should have taken their clues from AB-InBev in the United States. Although AB-InBev lost 17 million hl in sales volume in the U.S. between 2008 and 2012, they continued to hike prices from USD 110 per hl to USD 126 per hl, thus growing their EBITDA from USD 4.7 billion to USD 6.1 billion in the same period. Other brewers did the same.

Did the U.S. anti-trust watchdogs smell a rat? No. Because it's standard business practice, dictated by economic logic, to raise prices. You don't have to resort to illegal tomfoolery to do so.