Retailers push private label beers

Retailers’ mind-sets never fail to baffle. Viz Russia. Why several of the country’s leading retail groups decided to sell their private label (PL) beers in these controversial big plastic bottles is beyond me. Why not offer PL beers at both ends of the price range as the British retailer Tesco does with its “Tesco Finest” and “Tesco Everyday Value” ranges?

Besides, wouldn’t the ban on kiosk sales as of January this year have driven enough traffic through the retailers’ doors to make such a two-thronged policy viable? Kiosk sales accounted for one third of overall beer sales, it was reported. From what we hear, the ban has not been fully enforced yet. But gradually punters will have to migrate towards what is called the modern trade (ie supermarkets) or they will be left without their beer.

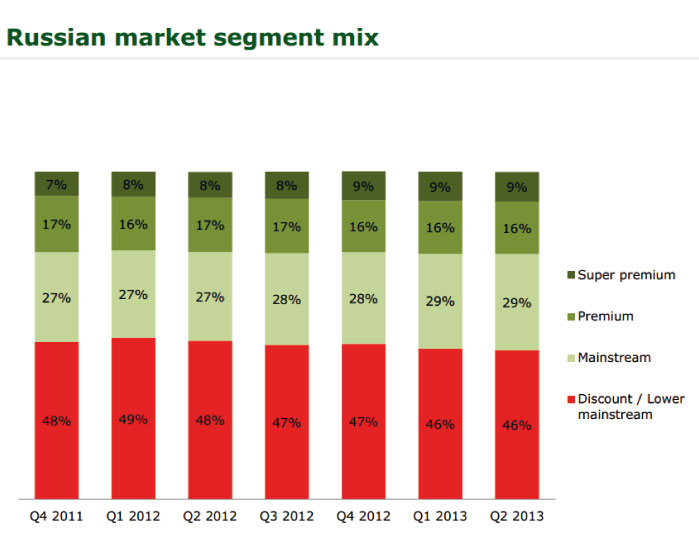

So far, the Kremlin’s campaign against alcoholism through new regulations and higher taxes has been successful, considering that in 2012 the beer market went flat following years of decline. Across the industry, sales have dropped 20 percent by volume since 2010 as per capita consumption slipped 13 percent due to rising prices.

However, one segment to grow was private label (PL) beers. PL beers have been rising in popularity since their first appearance on the Russian market in 2007. While initially attracting consumers through their competitive prices, PL beers also managed to gain a reputation for quality. Nevertheless, it was the almost total ban on beer advertising (including TV, mass media, the internet and outdoors) which stemmed the influence of big brands and paved the way for the lesser known PL segment to increase by almost 150 percent over 2011.

In order of magnitude, Russia’s major PL beer brands are (retailer/owner in brackets):

Magnit (Tander – Magnit)

Brigadirskoye (X5 Retail Group)

Khlebodorov (Dixy)

365 Dney (Lenta)

Canadean reckons that the whole PL beer segment is only 0.3 percent of the total beer market. In comparison, PL brands represent over 1.5 percent for the whole Russian FMCG sector, estimates GfK, another market research company. That’s low given that the global PL average 2011 stood at 15 percent of sales according to Planet Retail, a consultancy firm.

PL’s relative insignificance in Russia can be explained by the retail sectors’ low concentration level. The top 10 retailers are responsible for only 23 percent of total FMCG sales, says GfK. Perhaps retailers also find it hard to establish long-lasting and trusting relationships with contractors, as private label manufacturing brings little profit.

Besides, retailers’ PL beers face strong competition on the shelves from “commodity beer brands” like Zhigulievskoye. Commodity brands, which are unique to Russia, Belarus and the Ukraine, are generic "brands" that were originally developed in the Soviet era. Any brewer can produce them as no one "owns" the brand. They are always priced well below the mainstream.

Commodity brands, says Canadean, were beginning to die out but have picked up since the economic downturn and now represent 6 percent of the total market.

The best-known Soviet beer brand, Zhigulievskoye, accounts for over 90 percent of all "commodity" brand sales and is virtually synonymous with basic beer. The only other significant commodity brands are Moskovskoye Bochkovoye and Yantarnoye.

They are mainly packaged in large (1.5 litre /2.5 litre) PET bottles, although some volumes are still in 0.5 litre returnable bottles. Prices are around 120 rbls for a 2.0 litre PET bottle and 90 rbls for 1.5 litre PET bottle. 0.5 litre bottles are around 35 rbls. This compares to around 42/45 rbls for a 0.5 litre bottle of Baltika 3. (100 rbls = EUR 2.26/USD 3.03)

The major producers of commodity beer brands are (in volume order) Carlsberg/Baltika; Heineken; Ochakovo and Sun-InBev.

Nonetheless, retailers see PL products as offering strong advantages in terms of price competition in the longer term. That’s why Canadean forecasts that their volume will continue to rise in 2013.

PL and commodity brands heat up competition in the discount beer segment