AB-InBev’s need for SABMiller mega-deal grows. Oh really?

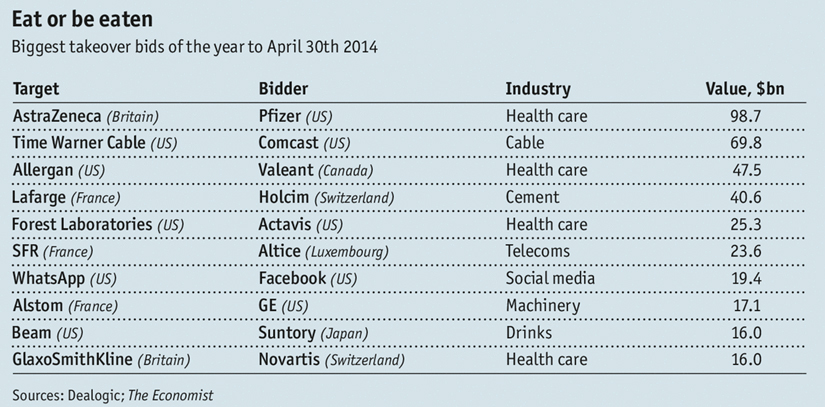

The last week in April 2014 launched a new fashion in corporate takeovers: the return of the “big deal”, as The Economist newspaper wrote on 30th April. We learnt that Pfizer and AstraZeneca, two drugmakers, Holcim and Lafarge, cement companies, and Publicis and Omnicom, advertising firms were planning to combine. Among other big deals (see table below), GE and Siemens are both bidding for Alstom, a French industrial rival. According to The Economist, there have been 15 transactions each worth more than USD 10 billion so far this year, the most since the record mergers & acquisitions rush of 2007.

Although these big moves come in fashionable waves over many different industries, pressure is piling on almost all industries to do “statement deals”. The reason? Well, plenty of companies, all of them leaders in their industries, have been generating huge amounts of cash but don’t really know what to do with it. “Having run out of scope for placating shareholders with share buy-backs, and having found that expanding into China and India was no panacea for their dim domestic prospects, they now hope that plausible-sounding mergers will do the trick”, The Economist argued.

What makes these big deals interesting is their rationale. In the Noughties, many of the big deals were moves into emerging markets. This year’s transactions appear to be about cost savings, pricing power and economies of scale, rather than acquiring operations on the ground or markets themselves.

Obviously, each company has its own motives for deal-making. However, we should never underestimate the power of investors in forcing deals. I am sure I am not alone in believing that the investment banking community is still very influential in effecting change, even if only for change’s sake.

That’s why I have been wondering about how long AB-InBev will be able to resist going after SABMiller, respectively ranking one and two in the global brewing industry. Of course, AB-InBev + SABMiller has been the most speculated about deal in beer land, even before the recent spate of mega-deals. For several years, in between the silly season and the reporting season, we have had the “who-could-buy-SABMiller”-season, marked by a flurry of articles and reports on the issue. Usually, it would have been an investment outfit that fed the media a report detailing why AB-InBev buying SABMiller made perfect sense. But, as we all know, nothing has come of this speculation – yet.

This year might prove different. In early March 2014 Bloomberg wrote that “slowing growth at Anheuser-Busch InBev and a dearth of big takeover targets may finally drive the world’s biggest brewer to swallow its USD 79 billion rival, SABMiller Plc.” Bloomberg added that tapping into SABMiller’s presence in faster-expanding regions such as Africa would allow AB-InBev to get that growth flowing again, quoting Alpine Woods Capital Investors LLC and Henderson Global Investors. The remarkable thing is that both Alpine Woods and Henderson are shareholders in AB-InBev and decided to go public with their opinion.

That followed a February 2014 report by investment bankers at Goldman Sachs saying that AB-InBev had “headroom for USD 145 billion of acquisitions”. This suggests that AB-InBev could afford buying SABMiller even at a premium.

I have no idea how SABMiller’s executives responded to all those analysts’ reports outlining the feasibility of such a tie-up when they sat down with their investors for a face-to-face.

Publically, they have never said “no” to “MegaBrew”, as this deal has been dubbed. In early 2012 SABMiller’s then CEO, the late Graham Mackay, was quoted as saying in response to the question if the deal was in the cards: “I’ll tell you what I tell my shareholders who ask the same question. Look, they would have to write a very big check indeed, something north of USD 100 billion and that’s a lot of money in anybody’s language. ... There’s a question of whether they can raise it in this environment. ... But it’s my job to make it very expensive for them.”

His successor, SABMiller CEO Alan Clark, told Bloomberg News in January this year that the case could be made for a tie-up, even though it would likely require divesting some U.S. operations to appease regulators. “You could get the numbers to work,” Mr Clark said. “There would be value loss and value destruction because they’d know that they’d have to sell the U.S., though.”

Ultimately, it’s up to SABMiller’s shareholders if they want to accept an offer by AB-InBev or not. Perhaps this is the time they could be swayed as the optics of SABMiller’s past quarter (January to March) were not pretty, as one insider put it. In addition to the weak share price, there were the following developments: labour force reductions at their soft drinks operations in South Africa, the stake in Tsogo Sun hotels under review, Norman Adami retiring. Besides, there is a lot of talk about getting more involved in soft drinks rather than beer.

As I see it, opinion is divided among beer industry analysts if MegaBrew is really such a good idea. Many say that only parts of SABMiller are interesting to AB-InBev. While Africa and Latin America would make a neat fit, all agree that there are question marks hanging over North America (how much will Molson Coors pay for SABMiller’s stake in the MillerCoors joint venture should regulators insist on its divestiture?) and China (does CRE, SABMiller’s joint venture partner in CR Snow, really want AB-InBev at their table? How will the Chinese government react to AB-InBev suddenly controlling over 30 percent of the Chinese market?). And what about the Turkish Efes Group? Or France’s Castel? SABMiller holds stakes in each of them. Will they be willing to carry on with AB-InBev?

No wonder, Trevor Stirling, an analyst at Sanford C. Bernstein in London, whose opinion carries some clout in the industry, went on the record in March 2014, saying: “Given the size of the transaction, it would be a stretch, and massively complex, though still feasible.”

However, given this past week’s events, investors may consider these complexities less of an obstacle than being left outside all this heady M&A activity. That’s why I suspect: if the investment community feels the time is right for MegaBrew (read: it can be financed) it will happen.