SAB Miller unit KP expects recovery of beer sales this year

Kompania Piwowarska (KP) has stated that it expects beer sales to rise this year thanks to the 2014 Football World Cup. The brewer, which is Poland’s number one and a unit of SABMiller, produces popular brands such as Lech, Tyskie, Redds and Zubr. At the end of May 2014 KP reported that its sales dropped by as much as 9 percent in its 2013/2014 financial year (31 March 2014), while the overall beer market only declined by 2.5 percent to 37.3 million hl.

The brewer believes the Polish beer market will grow to 37.9 million hl by year-end.

KP witnessed a market shift of beer consumption from restaurants to retail. Other market trends included the growth of the premium and super-premium brands, and a decline of the mainstream segment.

Poles drink 100 litres of beer annually, new data by the Central Statistical Office show, giving them a place among the top 5 beer drinking nations. The Polish beer market has grown impressively since the 1990s. In the first decade of the 21st century, the consumption of alcohol in Poland increased by 30 percent, with half of this growth generated by beer, making it the most frequently consumed alcohol in Poland, the Polish Ministry of Treasury reported on 23 May 2014.

There are currently 97 breweries across the country, but production centres around three big companies, which control over 85 percent of the market.

The biggest beer producer is KP with a 38 percent market share. The second biggest beer maker in Poland, which owns the Żywiec, Warka and Tatra brands, is Heineken-controlled Grupa Żywiec, with a market share of about 30 percent. Ranked third is the Carlsberg group, which owns brewers Okocim and Kasztelan, with a market share of around 20 percent.

The rest of the market belongs to smaller companies producing niche, craft or regional beers and to the growing number of microbreweries. The development of this small but dynamic segment of the market can be exemplified by the number of new breweries opening up in Poland: 21 in 2013 alone.

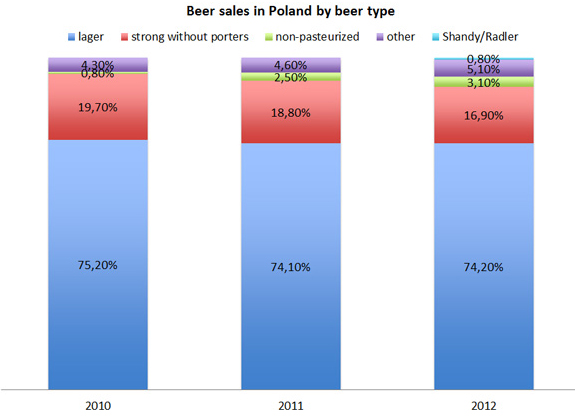

With the boom in microbreweries comes a marked shift from traditional lager towards niche brands. Although the market declined last year, both small and big brewers that offer craft or flavoured beers have recorded two-digit growth rates in these segments. The flavoured beers segment alone has gone a long way from a market share close to zilch in 2011 to 11 percent in 2013. The sub-segment of Radler, a mix of lemonade or juice and beer, has achieved the highest growth rate of 10 to 20 percent, according to Carlsberg.

Danuta Gut, Director of The Union of Brewing Industry Employers in Poland, was quoted as saying: “Years of investment in education about the culture of beer have borne fruit, not only by forming a group of beer experts, but also by creating a large group of beer enthusiasts. Today, customers expect something more, including novelty, and there’s a lot of room in the market for novelty. 2014 will therefore be a year of new products and flavours.”