Carlsberg refuses to close breweries despite beer market decline

Is it hope over realism that Carlsberg have decided to keep all of their Russian breweries open and running in the face of dwindling capacity utilisations? The beer market in Russia fell by 8 percent in 2013 and 5 percent in the first quarter 2014, media say. In fact, since 2008, beer sales in Russia have declined by 25 percent, hurt by various restrictions on sales and tax hikes, which must have led to many breweries now sitting on huge and costly overcapacities.

It was reported that in the past few years, AB-InBev have closed three breweries and Efes two, while Heineken closed one and put one up for sale, causing Heineken to write off EUR 102 million in 2013 due to the impairment of assets in Russia.

In spite of widespread fears that the beer market will witness another decline this year, Dr Isaac Sheps, who is President of Baltika Breweries and Senior Vice President Eastern Europe of the Carlsberg Group, admitted to media in June 2014 that “it is not easy, we do have empty capacity, but strategically we are trying to hold on to our assets because there is a reason to believe that this market will come back to growth.”

Mr Sheps said that almost none of Baltika’s ten Russian breweries were operating at full capacity but the maker of Baltika and Tuborg beer had faith that Russians would soon return to beer when they had got used to the new regulations and the economic crisis had eased.

“If you had in 2008 77 litres-per-capita consumption and we ended 2013 with 59 litres, this is a gap which cannot come from the change of behaviour or attitude towards beer. It is coming from different external pressures, so when these pressures are eased, we do believe that these numbers will go back”, he was quoted as saying.

In May this year Russia’s number one brewer Baltika was forced to cut its outlook for the Russian market and now expects it to decline by mid-single-digit percentages in beer volume in 2014, compared with the earlier guidance for a low single-digit decline.

Mr Sheps also said that if the beer market fell at the same pace for another year or two, Carlsberg would most probably be forced to close some breweries — although the company would do all it could to prevent that from happening.

The ban on kiosk sales of beer has hurt brewers really hard. Thus, to make up for a lack of impulse buying, brewers in Russia are using multipacks to encourage consumers to stock up at home while also focusing more on premium brands to attract high-income consumers, usually the last to be hurt when the economy falters.

Mr Sheps noted that beer sales in multipacks started slowly but were gathering pace and the company was also bringing in new varieties in all price categories to reinvigorate consumer interest.

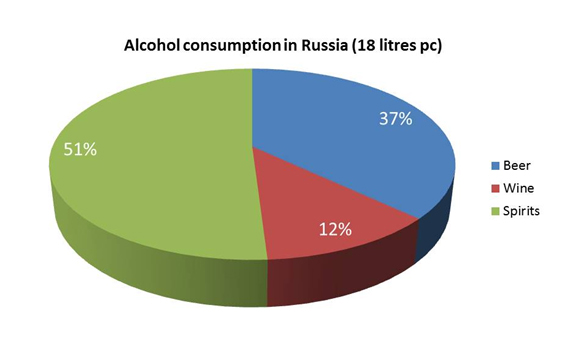

Several market observers are doubtful that Russian consumers will ever drink as much beer as they did in the past as they seem to have reverted to their old ways of alcohol consumption: illicit vodka accounted for 55 percent of the entire vodka market in 2013, estimated Igor Kosarev, Vice President of distiller Russky Standart, earlier this year.

This is hardly surprising, given that due to several tax hikes, the lowest retail price for a half-litre bottle of vodka has been pushed up to about 250 rubles (USD 7.00). The minimum legal re-sale price also climbed to 199 rubles (USD 5.50) in 2014 from 125 rubles (USD 3.50) in 2012.

Just as illegal vodka is pouring into the market, so are imports from Kazakhstan, where vodka is significantly cheaper on account of lower excise duties. Total legal vodka production in Russia fell 12 percent in 2013, according to the Federal State Statistics Service, and is still plummeting.

In fact, Russians may not be drinking less alcohol overall, they are just drinking more potent moonshine.

Therefore, many wonder: when will the Russian Government feel compelled to freeze or even lower the excise tax on spirits? When the tax hole will get too big? Or when vodka producers start to protest more loudly? Unlike beer, vodka is a “strategic” industry in Russia, national health concerns aside.

Perhaps Carlsberg will have to adopt a more realistic view of the future for beer in Russia in the end.