Carlsberg hammered by falling Russian beer sales

Is this the answer? Carlsberg, whose Baltika unit is Russia’s biggest brewer, plans to fill some bottles with less beer and make others smaller in order to limit price increases amid political upheaval, its CEO Jorgen Buhl Rasmussen said on 20 August 2014.

Two days later, Russian media reported that the Danish brewer plans to close one or two breweries (out of ten) in the country – but not its St Petersburg brewery which is its largest and one still believed to run profitably.

Only in June, Isaac Sheps, President of Baltika and Senior Vice President Eastern Europe of the Carlsberg Group, had told Russian media that Carlsberg will keep its breweries in Russia running even at reduced capacity, while other brewers were closing plants.

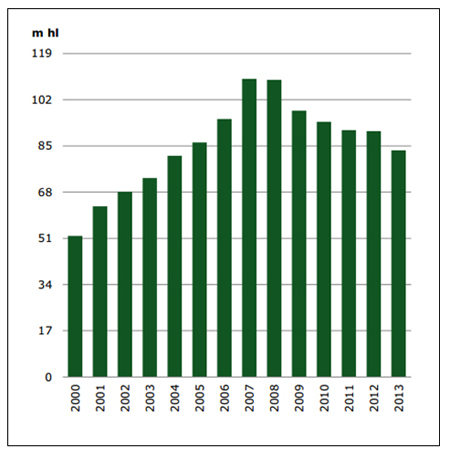

So what’s happened between June and August? Sales at the Danish brewer have been hit badly by falling consumption in Russia and Ukraine. Carlsberg said Russian beer volumes – which account for more than a third of its business – fell between 6 and 7 per cent in the second quarter.

The Ukraine’s beer volumes fared even worse: Ukrainian beer consumption dropped 10 percent amid the crisis in Eastern Europe and a beer tax increase of 43 percent in May, by which the Ukrainian government hoped to steady its public finances.

Despite the tensions, Carlsberg’s rival Heineken reported “strong brand growth” in Russia in the first half of the year. Its premium Heineken brand grew by more than 5 percent in central and eastern Europe in the period.

Nevertheless, in Russia, Heineken’s group beer sales fell 4.2 percent in the half-year.

In its outlook for the full year Carlsberg said it now expects the Russian beer market to decline by high single-digit percentages. As a result it warned that its 2014 profits would likely decline in the low to mid-single digit percentages versus last year.