Heineken said to mull over the sale of Czech operations to Molson Coors

It’s a rumour only, but further consolidation of the Czech beer market would make sense. Czech media reported on 9 September 2014 that Heineken is in talks about selling its Czech operations to Molson Coors.

Needless to say, both Heineken and Staropramen, the country’s second biggest brewery which is owned by Molson Coors, declined to comment on the rumour.

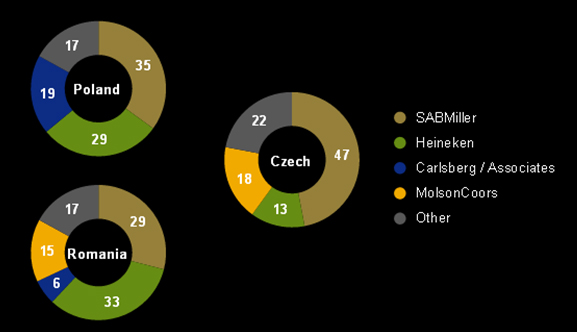

Heineken is the number three brewer in the Czech Republic, which it entered in 2003 with the acquisition of Starobrno. In 2007, it bought the then German-owned Krušovice brewery (from Radeberger), increasing its market share to 8 percent. But even with the purchase of Drinks Union in 2008, Heineken’s share has languished at around 13 percent.

Same with Molson Coors. It acquired Staropramen in 2012 when its then owner, the private equity-controlled brewer StarBev was sold for USD 3.5 billion. Staropramen’s market share is 18 percent.

As beer marketers have had to learn the hard way: market shares in the low double digit percentages don’t get you far if you want to reap high margins vis à vis a powerful rival that controls nearly half of all beer sales. SABMiller’s unit Pilsner Urquell has a 47 percent market share.

Czech consumers may moan that if Heineken were to exit, the beer market would be controlled by only two big groups. But there is still the state-owned Budweiser Budvar with about 8 percent of Czech beer sales. So all is not lost.

Central and eastern Europe: too many fragmented beer markets (brewers’ market shares % in 2013)

Keywords

Czech Republic international beverage market

Authors

Ina Verstl

Source

BRAUWELT International 2014