A beer paradise no more

Isn’t it funny that the Belgian government should announce a beer excise hike at the end of July 2015 when everybody was on holiday? The timing was impeccable. No media outcry ensued. Which must have been the whole point of the summer exercise.

The planned beer excise hike is far from minuscule. Although the government has not said yet when the new excise regime will be implemented – some reckon 1 January 2016 – and how high it will be, it could have far reaching consequences, especially if Belgian brewers pass the increase directly on to consumers and don’t absorb it themselves.

Belgian brewers could be presented with an excise hike of 15 percent, which translates into an excise load of EUR 25.47 (USD 28) per hl of beer with 4.8% ABV.

Since most small brewers produce quite some volume of higher strength beers between 6.2% and 9% ABV, the excise rise could be felt far and wide. For example, the Trappist tripel Westmalle might have an excise load almost twice the amount levied from a 4.8% ABV beer.

Belgium’s major brewers AB-InBev and Alken Maes (owned by Heineken) may squirm. However, they will ultimately console themselves by pointing to France where excise on beer was raised by 160 percent in 2012. Incidentally, domestic beer production in France – mostly pils-type beers – did not suffer as much as feared. But sales of imported Belgian beer specialties, in particularly in the higher alcohol range, dropped 10 percent in total because these beers had become excessively pricey.

Many insiders contend that this tax hike may not make Belgians drink less beer, it will only make them travel further to buy their beer. Cross-border shopping in Germany is most likely going to intensify. The Belgian on-trade will suffer accordingly. As to the government’s plan to raise revenues from alcohol – that’s wishful thinking.

The report “Economic effects of high excise duties on beer”, co-authored by Ernst & Young and Regioplan (19 December 2014) concluded:

“Analysis of increases in excise duty in the EU (2008-2012) shows that high excise duty rates (such as the ones in the Nordic countries) impact negatively on the economy. In addition to negative effects on employment, excise duty increases also ultimately failed to bring about a proportional increase in total beer-generated government revenues. In eight of the seventeen countries in which an excise duty increase was implemented (16 EU countries and Norway) beer-generated government revenues even decreased.”

Perhaps Belgium’s government thinks it will not share the Nordics’ experience, or, if it does, it will serve a higher goal, namely make Belgians drink less alcohol overall.

Last year, Belgium’s per capita beer consumption was 72 litres, far below Germany’s or the Czech Republic’s. Observers say that the registered decline in beer consumption in Belgium can partly be attributed to rising excise. This means that beer consumption will continue to drop as a consequence of the intended hike.

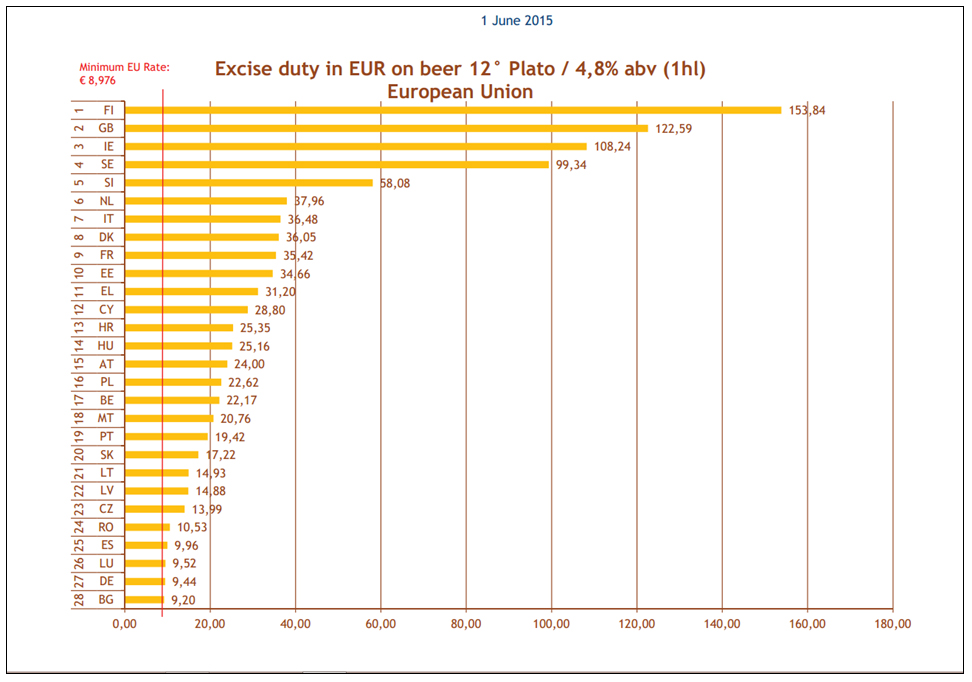

One thing is certain, though: following the government’s summertime excise coup, Belgium will move further away from Germany and closer to the Nordics. And no one, in their right mind, would call the Nordics beer countries.

So bid your adieus to Belgium’s beer paradise.

Beer excise in Europe

Keywords

Belgium international beverage market legislation taxation

Authors

Ina Verstl

Source

BRAUWELT International 2015