AB-InBev puts Peroni, Grolsch and Meantime up for sale

That’s a good one. AB-InBev said on 3 December 2015 that they are exploring the sale of a number of SABMiller’s European premium brands to address “regulatory concerns” ahead of their planned merger.

On the block are Peroni and Grolsch and their associated businesses in Italy, the Netherlands and the UK. And while they are at it, AB-InBev are also seeking a buyer for London’s Meantime, a 16-year-old London craft brewer that SABMiller bought earlier this year.

Many wonder: why did AB-InBev not just admit that these brands and businesses are surplus to their requirements? To spare SABMiller’s employees any distress?

True, there could be regulatory issues. AB-InBev and SABMiller will have a combined market share of 30 percent in Italy and 27 percent in the Netherlands. In the UK it will be 21 percent.

As regulators scrutinise market share within segments—like premium and mainstream—rather than overall market share, AB-InBev probably think that they can get over the loss of the premium brand Meantime because their own brands, Stella Artois and Corona, are already large players in the UK’s premium segment.

But as any old AB-InBev watcher will confirm, AB-InBev is not really interested in Old Europe. Or why did they sell off their central European business to the private equity firm CVC after the formation of AB-InBev?

To AB-InBev, Europe’s beer markets are a struggle and profits are far too low for their liking. In fact, Europe would only constitute 7 percent of profits under MegaBrew, according to Nomura’s estimates, as Europe has lower EBIT margins than the group’s average (about 16 percent versus 24 percent for the combined group).

At Meantime, they possibly still cannot believe their good luck – that they completed their exit strategy and sold the 60,000 hl brewery to SABMiller in May 2015 before SABMiller was taken over. No financial details of the transaction were released, but considering the high multiples UK craft brewers enjoyed at the time, the money that changed hands must have been impressive. This time round the multiple that a buyer of Meantime will have to pay could be lower.

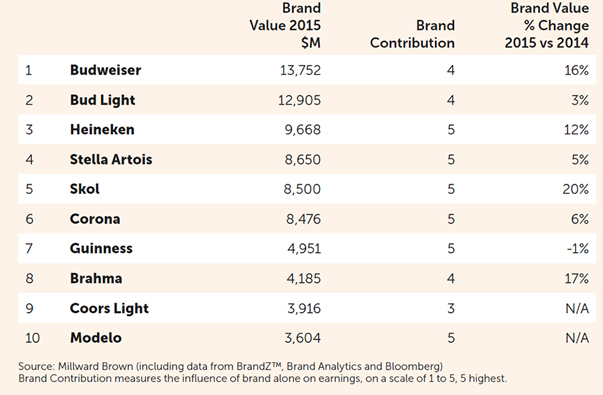

Peroni and Grolsch are two of SABMiller’s four global brands, the others being Miller Genuine Draft and Pilsner Urquell. Despite SABMiller’s best efforts, neither in terms of volume nor value (see chart) do these brands rank among the global top 10 beer brands.

The fate of Miller Genuine draft has already been sealed. AB-InBev’s agreement to sell SABMiller’s 58 percent stake in its U.S. joint venture MillerCoors to partner Molson Coors, announced last month, returns the world-wide rights to Miller Genuine Draft to Molson Coors.

Incidentally, AB-InBev’s announcement on 3 December 2015 makes no mention of Pilsner Urquell, a strong indication that AB-InBev plans to keep the premium brand. That is likely because Pilsner Urquell’s biggest market is the Czech Republic, where AB-InBev has only a small presence, yet SABMiller enjoys a 44 percent share.

It’s kind of hard to estimate how much Grolsch, Peroni and Meantime will fetch. In Italy, the Netherlands and the UK, SABMiller last year earned over USD 100 million in profits (EBIT), analysts say. Multiply this by 11 – the going rate apparently – and add quite a bit of extra for the brands – and the guess is yours. Stifel analyst Mark Swartzberg was quoted as valuing the brands at over USD 3.2 billion.

Who could be a buyer for these brands and businesses? Analysts point to the usual suspects like Molson Coors, Carlsberg, the Irish C&C Group, and possibly private equity.

Heineken would be excluded given they are the major player in Italy, the Netherlands and the UK. Molson Coors, with businesses in Britain and eastern Europe, might be interested but could be too stretched as they already have agreed to pay USD 12 billion for MillerCoors in the United States.

Carlsberg is bogged down by a struggling Russian business, while the Irish cider maker C&C could similarly be stretched and reluctant to expand until its U.S. business is turned around.

In view of these reservations, this would leave private equity firms as the most likely buyers.

As usual, it’s wait and see.

Keywords

Belgium acquisitions international beverage market mergers

Authors

Ina Verstl

Source

BRAUWELT International 2015