MegaBrew will be a global beer monopoly

It took the head of The Public Investment Corp (PIC), a South African state-owned pension fund and SABMiller’s fourth-largest shareholder, to point out the obvious: a takeover of SABMiller by AB-InBev would not only create a global brewer, which controls about 30 percent of the world’s beer volumes and a mind-blowing 58 percent of all beer industry profits, it would above all establish a monopoly that is too dominant and thus will hurt consumers.

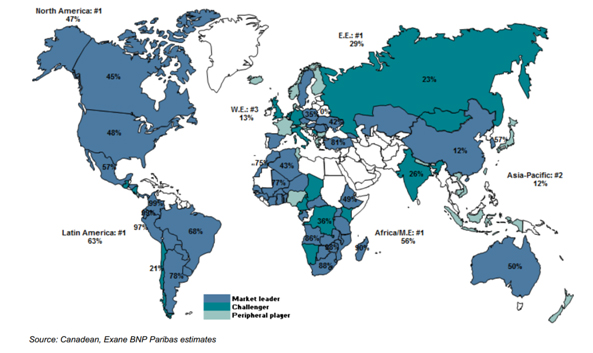

In actual fact, a merger would see a single beverage empire controlling the number one or number two position in 24 of the world’s 30 biggest beer markets, according to bank Exane BNP Paribas.

By any measure this translates into a monopoly as 97 percent of all beer is produced in merely 40 countries.

“Quite frankly I’m not in favour of it,” PIC CEO Daniel Matjila told Bloomberg on 6 October 2015. “We may be creating some kind of a monopoly going forward which may have a serious impact on the global economy and beer market in general.”

Mr Matjila must have had Africa in mind when voicing his concerns. For the first time, on 7 October 2015, AB-InBev showed its true colours when it explained the rationale for the takeover. Its public offer states that it regards the African continent as critical driver of future growth.

With 140 million hl beer produced in 2014 according to the Barth Report, African countries together only brewed as much beer as Brazil alone and circa 7 percent of the world’s output. On average, Africans drink nine liters of beer per person, per year, compared with a global average of 45 liters. Africans prefer fortified wines, rice wine and, quite often, cheaper homemade alcohol. Illegally made alcohol continues to dwarf the legal market in Africa, according to SABMiller because of price.

Although SABMiller has chosen low price points for some of its beers to lure Africans away from moonshine, beer is still relatively expensive. Eight hours of work is needed for the average African to make enough money to buy a beer, compared to just eight minutes in Europe. As a result, SABMiller’s strategy has hinged on fewer price increases with a greater focus on volume.

This is not to say that in its African markets, where it often enjoys monopolist positions, SABMiller acted like a charity. In its past financial year (ended 31 March 2015) it reported that 30 percent of its group profits or USD 1.9 billion (EBITA) came from Africa.

But Mr Matjila and perhaps other South Africa institutional investors, which together own 20 percent of SABMiller’s shares (according to bank Credit Suisse) fear that SABMiller’s culture of doing business, which always paid special attention to African sensibilities, could be swept aside by AB-InBev’s more profits-oriented approach, which would affect African consumers adversely.

“Doing business in Africa, for example, is very different to anywhere else. Knowhow and relationships are crucial. AB-InBev has neither with regards to doing business in Africa”, Exane BNP Paribas pointed out in a March 2015 report.

AB-InBev has until 5pm on 14 October 2015 to table a formal offer or walk away from SABMiller for at least six months under the UK Takeover Panel’s rules. It is widely believed that SABMiller will ultimately succumb to a final, sweetened offer around the mid GBP 40s per share.

World beer monopoly: blue is the colour (and market leadership)

Keywords

acquisitions international beverage market mergers

Authors

Ina Verstl

Source

BRAUWELT International 2015