SABMiller awaits next letter from AB-InBev

So it will be MegaBrew after all? AB-InBev, the world’s number one brewer has approached the world’s number two brewer, SABMiller, to explore a tie-up, which analysts have dubbed MegaBrew. In a statement on 16 September 2015, SABMiller said it had been informed that AB-InBev intends to make a bid proposal for the company.

“No proposal has yet been received and the board of SABMiller has no further details about the terms of any such proposal,” it said. “The board of SABMiller will review and respond as appropriate to any proposal which might be made.”

Doubtlessly, another letter from AB-InBev with a specific offer will soon drop through SABMiller’s letter box. Readers will remember that, when InBev bought Anheuser-Busch in 2008, InBev’s CEO Carlos Brito sent a letter to August Busch (11 June 2008) and five weeks later Anheuser-Busch was sold.

This time round things could happen equally quickly. In any case, under UK takeover rules, AB-InBev has 28 days, specifically until 5 p.m. in London on 14 October 2015 to either make an offer or walk away. Known as the “put-up-or-shut-up” rule, if AB-InBev decides to walk away from the transaction it can’t come back for six months.

It is unclear if SABMiller really wants a deal. It all depends on how the cigarette company Altria, the largest shareholder in SABMiller with a 27 per cent stake, views the offer. AB-InBev will also need to persuade the family of Alejandro Santo Domingo, among the richest clans in Colombia and the owner of a 14 percent stake in SABMiller.

After years of speculations, analysts say that AB-InBev will now have to pay at least a 30 percent premium over SABMiller’s undisturbed share price, which isn’t easy to determine, but which has been put between GBP 30.00 and GBP 32.00. If AB-InBev pays around GBP 40.00 a share, which Nomura, a bank, thinks likely, SABMiller will be valued USD 100 billion. Plus debt and minority interests this will add up to USD 112 billion, says Nomura in its most recent report (17 September 2015).

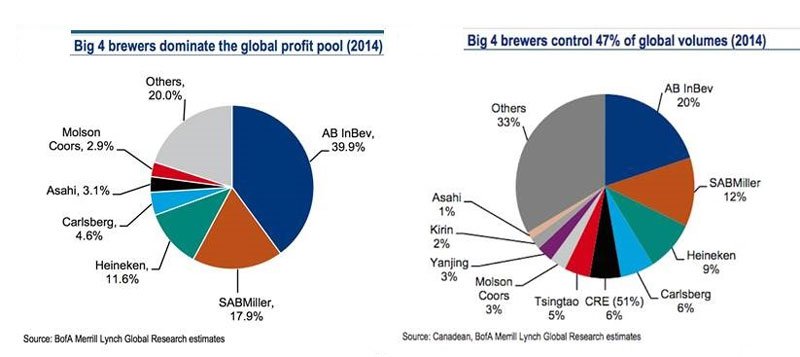

Although media commentators salivate at the idea that the transaction would create MegaBrew, controlling over 30 percent of global beer volumes and – more importantly – an estimated 58 percent of the global beer profit pool, this is far from certain. Rest assured that the deal will face objections from several anti-trust agencies.

In fact, the combination could set off a chain reaction that would force valuable assets onto the market and lead to a shakeout in partnerships and alliances around the industry.

There is consensus among market observers that AB-InBev will need to sell off SABMiller’s stake in MillerCoors, its U.S. joint venture with Molson Coors, and its stake in the CR Snow joint venture in China. This could lead to perhaps USD 15 billion in disposal proceeds.

Likewise there are question marks behind SABMiller’s partnerships with Castel in Africa and with Efes in Russia and Turkey. AB-InBev likes to control its businesses, which is why SABMiller’s long tail of associates could be sold.

Nomura analysts believe that AB-InBev is foremost interested in SABMiller’s Latin American units and the large, cash generating markets of South Africa and Australia, where SABMiller has strong positions. Unlike the media and its penchant for global domination metaphors, analysts think that AB-InBev is motivated by hard financial logic only. Therefore, if there is an opportunity for disposals, most of SABMiller’s businesses in Europe and Africa (except South Africa) will go.

Eventually, when an offer is on the table, AB-InBev will have to explain its rationale. It will probably sound very convincing. But as observers concur: there is strong pressure on both managements to create value for shareholders, especially in a world in which currency fluctuations and slower macroeconomic

conditions are creating more headwinds for profit growth. No wonder, a deal may seem like a good idea right now.

“Megabrew” will reduce Heineken and Carlsberg to second-tier brewers