An irate AB-InBev makes public offer for SABMiller

At last. On 7 October 2015 AB-InBev announced that it wants to acquire SABMiller for GBP 42.15 per share in cash, which would value SABMiller, including debt, at GBP 72 billion (USD 110 billion).

AB-InBev also said that it has made two prior written proposals in private to SABMiller, the first at GBP 38.00 per share in cash and the second at GBP 40.00 per share in cash.

Arguing that the revised proposal is highly attractive for shareholders, AB-InBev stated that it is “disappointed that the Board of SABMiller has rejected both of these prior approaches without any meaningful engagement.”

The offer is certainly high and already in the “realms of value destruction” according to some analysts.

But what is interesting to note here is that AB-InBev has adopted a threatening posture, while SABMiller outwardly shows no signs of wanting to surrender.

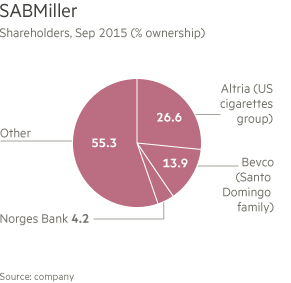

In its public statement AB-InBev claims it has the support of SABMiller’s biggest shareholder, the cigarette maker Altria, for the proposed offer and that it expects SABMiller’s second-largest shareholder, BevCo, which is the Colombian Santo Domingo family’s financial vehicle, to back the proposal.

Apparently, this is not the case. SABMiller’s two biggest shareholders are split over AB-InBev’s latest bid. Only hours later, AB-InBev was forced by the UK’s Takeover Panel to clarify that it does not have the support of BevCo.

In its reply, SABMiller said that an offer of GBP 42.15 “very substantially” undervalues the London-listed brewer. In the M&A world, the choice of the term “substantially” is code for the underlying message that a company is seeking an offer that is at least 10 percent higher.

It has since transpired that two days previously, AB-InBev’s CEO Carlos Brito had put forward a GBP 40.00 per share offer and informally had let it be known that AB-InBev might increase its offer to GBP 42.00. Then already SABMiller’s board decided that even the informal offer was not enough. Huffing indignantly, SABMiller’s board pointed out the obvious and said that the most recent offer is barely higher than the informal one.

Apart from the unattractive price, the new offer is highly conditional.

In a statement to the London Stock Exchange, SABMiller said: “AB-InBev needs SABMiller but has made opportunistic and highly conditional proposals, elements of which have been deliberately designed to be unattractive to many of our shareholders.”

Since in a takeover battle, financial aspects are as important as psychological manoeuvers, AB-InBev’s latest move suggests that it now seeks to put pressure on shareholders and circumvent the SABMiller board.

This is likely to frustrate the SABMiller board and they will either cave in, or dig in and reject.

If AB-InBev succeeds in taking over SABMiller, it would be the third most expensive M&A transaction in history, according to Dealogic.

Keywords

acquisitions international beverage market mergers

Authors

Ina Verstl

Source

BRAUWELT International 2015