Diageo claims return to growth but currency woes hit profits

Which numbers shall we trust? On 28 July 2016, the leading drinks group Diageo reported like-for-like sales for the 12 months to 30 June 2016 that were 2.8 percent higher than the previous year, reversing a two-year trend in which growth was broadly flat because of a slowdown in emerging markets.

However, Diageo’s reported sales were down 3 percent to GBP 10.5 billion (USD 13.6 billion), as currency devaluations and the sale of its wine business hit the figures.

Pre-tax profit fell 2.6 percent to GBP 2.86 billion (USD 3.7 billion). Incidentally, its operating profits were reduced by GBP 170 million (USD 221 million) because of the fall in sterling, Diageo said.

Emerging markets, such as Nigeria and Brazil, were still a problem, with sales down 15 percent and 9 percent respectively, it was reported.

Growth in the company’s US business was broadly as expected at 3 percent in value terms. In recent years Diageo has struggled to come to terms with changing customer tastes in the US, as consumers turned away from vodka and towards spirits such as bourbon. The US is Diageo’s single biggest market, contributing almost half of its operating profit.

The drinks giant has also had to weather an economic slowdown in China and the government’s crackdown on corruption and gift-giving.

Apart from the drop in sterling, Diageo said it has not felt any impact from the Brexit referendum. In fact, because of the weaker pound, Diageo expects its full year 2017 sales to rise by about GBP 1.1 billion and operating profit by GBP 370 million.

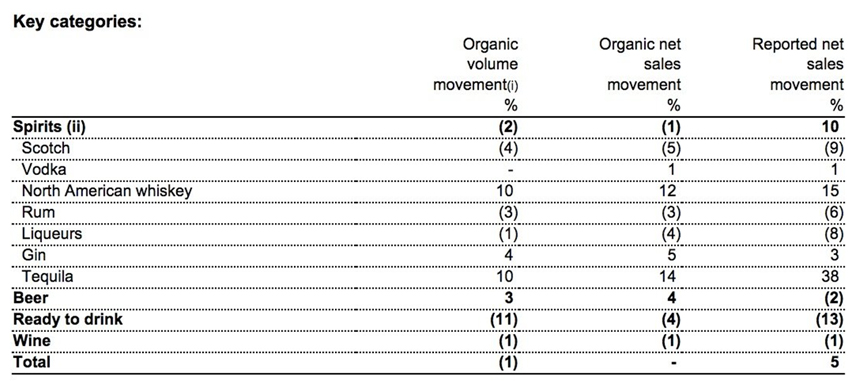

Don’t look at organic volumes. It’s reported movements that paint the real picture. Sales of most spirits are falling, with tequila and North American whiskey the only bright spots. Source: Diageo 2016