AB-InBev continues to struggle in the U.S.

Looks like the global beer party is over. AB-InBev on 25 February 2016 issued a warning that a slowdown in markets such as Brazil and China will weigh on the brewer this year.

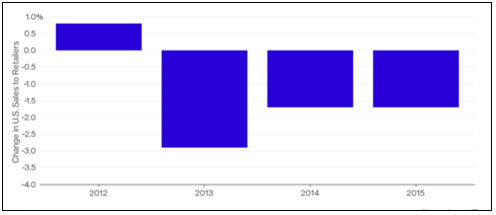

Releasing its full year results, AB-InBev admitted that in the U.S., things did not look all that rosy too. Its sales to U.S. retailers fell 1.7 percent in 2015. Global beer volume declined by 0.1 percent in 2015.

Bud Light, the top-selling U.S. beer brand, saw sales decline in the low single digits in 2015 and in the fourth quarter, dragging U.S. profits in the quarter down 7 percent.

Despite shrinking market shares of flagship brands Bud Light and Budweiser, AB-InBev remains the top seller of beer in the U.S., with a 46.4 percent market share, based on sales to retailers.

AB-InBev has focused on its core brands – Stella Artois, Budweiser and Corona – which all enjoyed strong growth on a global basis. Sales of Budweiser were up 7.6 percent, Stella Artois grew 12.5 percent while Corona leapt 23 percent, thanks to strong performance in markets such as Mexico.

Growth was spurred by heavy investment in marketing and sponsorship deals. The brewer increased its advertising budget by 10 percent to USD 7 billion for the year.

Resorting to only focusing on “organic growth”, AB-InBev managed to report that revenue, EBITDA and EBIT were up, whereas they were literally down over 2014. Revenues dropped to USD 43.6 billion from USD 47 billion in 2014; normalized EBITDA fell to USD 16.8 billion from USD 18.5 billion and EBIT to USD 13.7 billion from USD 15.3 billion.

No wonder they need the SABMiller deal to at least improve their figures.

AB-InBev: beer sales in U.S. 2012 – 2015 (volume)

Keywords

China USA Belgium Brazil international beverage market

Authors

Ina Verstl

Source

BRAUWELT International 2016