A silver lining?

There are signs that Russia’s economy is bottoming. Analysts say that Russia’s unemployment peaked in March 2016 at 6 percent, but declined to 5.3 percent in July. Inflation has been gradually slowing from 9.8 percent in January to 7.2 percent in July. They expect declining inflation to partially offset the headwinds from increasing price competition in the beer industry.

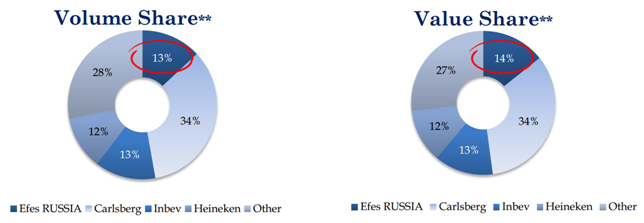

Russian beer consumption dropped by an estimated 2 percent in the first half of 2016; in 2015 beer consumption stood at 69 million hl. For the full year Turkish brewer Efes, which ranks second together with AB-InBev, expects consumption to go down between 2 and 5 percent. For Efes the continuing decline will be harsh since its six breweries across Russia only work at 30 percent of capacity, according to estimates.

The Carlsberg Group’s outlook on Russia was less constructive, analysts said. For the remainder of 2016 Carlsberg expects the Russian market to remain difficult due to the macro economic situation and the trying implementation of the alcohol registry system, EGAIS, which will have some negative impact on the traditional retail sector.

In January this year, all alcohol wholesalers and retailers in Russia began their integration into the country’s electronic tracking and monitoring system (EGAIS). The system was extended to beer products. This mass integration will allow Russia to oversee the import, production, distribution and sales of all alcohol products within its borders, and will help to enforce against illicit alcohol entering the market. That’s the theory. In practice, the system tends to be unstable, meaning that consumers cannot buy a bottle of beer in a shop if the registration system is down.

Danish Carlsberg, whose Baltika is the major brewer in Russia, has reduced the price of its namesake brand in Russia by more than a third at the start of the year in an effort to make it more affordable for cash-strapped consumers. However, the brand’s share in Russia is insignificant in comparison to the brewer’s other international premium brands such as Tuborg and Holsten.

Meanwhile, it was reported that Carlsberg has raised the prices of some other brands in the market.

All brewers are also bracing for the ban on PET bottles above 1.5 litres, which comes into effect on 1 January 2017.