All those sin taxes …

It was a day of reckoning for alcohol and soft drinks producers. On 8 March 2017 the UK government said in its Spring Budget that the traditional “sin taxes” on booze and cigarettes would not rise, but a new one is being introduced in the form of the sugar tax.

It is one of the few flagship policies of former Prime Minister David Cameron continued by his successor Theresa May.

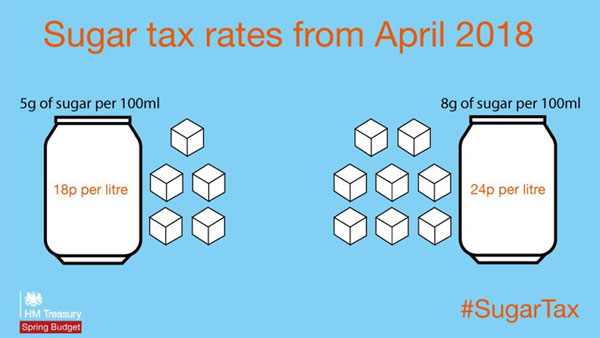

Producers and importers of sugar-filled soft drinks will see a tax hike in April 2018 in an attempt to combat rising levels of obesity. Proceeds from the sugar tax will go to the Department for Education (DfE) for school sports. The DfE is expected to receive an extra GBP 1 billion (USD 1.2 billion) from the sugar tax, provided companies do not reduce the amount of sugar in their products to avoid the tax – which they just might.

More imminently and in line with previously planned up-ratings in duty on alcohol, from Monday 13 March 2017 a pint of beer will cost GBP 0.02 more. A bottle of whisky will go up by GBP 0.36, while a bottle of gin will rise by GBP 0.34. Cider will be GBP 0.01 more and still wine GBP 0.10 more.

Charles Ireland, Managing Director of Diageo Great Britain responded furiously by saying: “It is staggering that the Prime Minister stood up in Scotland only on Friday and said that Scotch Whisky is ‘a truly great Scottish and British industry… and directly supports tens of thousands of jobs’, and just five days later her Chancellor hammers this industry at home. Tax on Scotch Whisky is now so high – nearly 80 percent of the price of an average bottle will go straight to the Government.”

Mr Ireland called on the government to reverse this punitive tax hike and fundamentally overhaul what is clearly a flawed excise duty system.

As could be expected, the hospitality industry was less than happy too that the Chancellor has raised duty on beer and wine by 3.9 percent – the first increase since 2012.

The industry continues to experience significant price pressures and this Budget has not helped. Paul Connelly, Managing Director of purchasing company Beacon, was quoted as saying that the duty hike “might be the final straw for many hospitality businesses which had been holding off passing price increases onto the consumer”.