Beer industry seeks to grow exports

After Scotch Whisky and chocolate, beer is the largest food and drink export from the UK worth around GBP 600 million (USD 795 million) per year, the British Beer and Pub Association (BBPA) argues in a recent report.

The sector has ambitious plans to grow exports further. The agreed target is to raise beer exports to GBP 700 million by 2022.

2016 saw exports from the UK increase 5.8 percent with six million hl of beer being sent overseas. This was driven within the EU as well as by sales to the rest the world with growth rates of 5.3 percent and 6.5 percent respectively.

The EU comprises 63 percent of total export volume with France, Ireland, Italy and the Netherlands being the largest markets. Outside the EU, more beer is sent to the US (1.2 million hl) than to all non-EU nations combined.

However, there are many markets that are in significant growth. Most of all China, which in 2016 saw beer volume increase fivefold. China is now the second largest non-EU market (and sixth largest overall). On top of this, there was also significant growth in India, Israel, Russia and Norway to name a few.

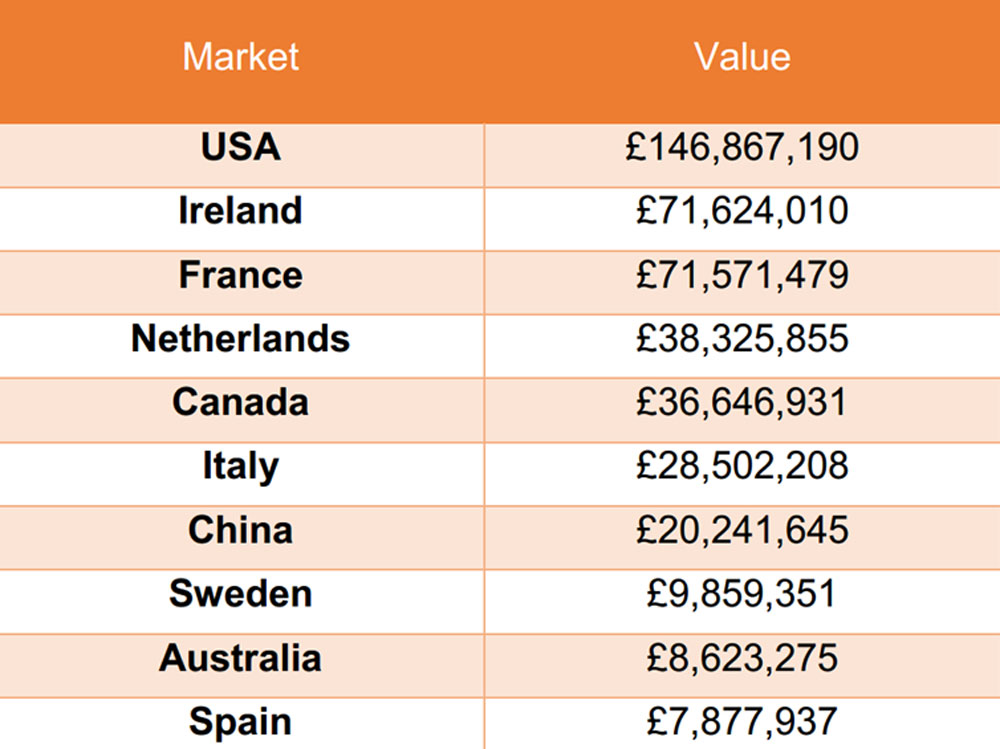

Measuring exports by value reveals further interesting and exciting insights, says the BBPA.

The US is the single biggest market by value, worth nearly GBP 150 million (USD 199 million) alone. In fact, non-EU markets are cumulatively worth GBP 320 million in 2016 which is 56 percent of the global total. Even more encouragingly, non-EU markets grew 21 percent on the back of significant growth in emerging markets.

However, when it comes to taxation the UK has one of the highest rates of beer duty in the EU, considerably higher than all other major brewing nations. This has resulted in a situation where brewing profit margins are so small in the UK that investments in greater export capability are increasingly difficult to justify.

This is exacerbated by a small brewer relief structure. Reductions start at 50 percent for production of 5,000 hl or less and decrease for larger production volumes. Whilst very generous for microbreweries, it disadvantages small and medium sized brewers which produce volumes above the threshold but which also have significant export potential. These issues need addressing, argues the BBPA.

Top UK beer export markets by value (2016)