AB-InBev’s profits up on Brazil recovery and SABMiller savings

Thanks to Brazil rebounding after two tumultuous years in the region and the integration of SABMiller proceeding well, AB-InBev reported on 1 March 2018 that revenue increased 5.1 percent in 2017 to USD 56.4 billion (EUR 46.3 billion) while profits (EBITDA) rose 13.4 percent to USD 22.1 billion (EUR 18.1 billion). AB-InBev’s EBITDA margin stood at 39.1 percent in 2017.

Combined revenues of the company’s three global beer brands – Budweiser, Stella Artois and Corona Extra – grew 9.8 percent year on year, with a 17.8 percent increase in the fourth quarter.

Total volumes saw an increase of 0.2 percent, with beer volumes up 0.6 percent and non-beer volumes down 3.1 percent.

Despite the dip in sales for its non-alcoholic offerings, AB-InBev said it is still committed to growing that portion of the portfolio to 20 percent of total sales by 2025. It currently makes up about eight percent of all sales. According to CEO Carlos Brito, low- or no-alcohol products already represent more than 20 percent of sales in five “main countries.” “That comes with higher margins if done correctly,” he said.

Additionally, AB-InBev's integration of SABMiller, following the 2016 merger, resulted in synergies and cost savings of USD 1.3 billion last year.

All could be nice and dandy for AB-InBev were it not for the US, where its brands Budweiser and Bud Light continued to suffer. The company’s shipments to retailers declined three percent and sales to wholesalers dipped 3.5 percent. This affected revenues which declined two percent.

Despite the continued struggle to grow sales of its mainstay brands, its high-end portfolio hiked sales, driven by double-digit volume growth for Michel Ultra. Stella Artois and the company’s craft portfolio also grew, the company said.

Premiumisation seems to have worked well for AB-InBev. The brewer recently created a High End Company. The business unit, which is tasked with “invigorating” beer, is now operating in 22 markets that account for 70 percent of the high end opportunities worldwide. The division brought in about USD 4.6 billion in revenue in 2017, Mr Brito added.

“These high-end brands – global brands, craft brands or specialty brands – they have way higher margins, even after sales and marketing investments,” he said.

AB-InBev expects continued revenue and EBITDA growth in fiscal 2018 to be driven by premiumisation and revenue management initiatives, particularly as it shifts its focus to category development. It forecasts that it will achieve growth in net revenue per hl above inflation for the year, while keeping cost increases below inflation.

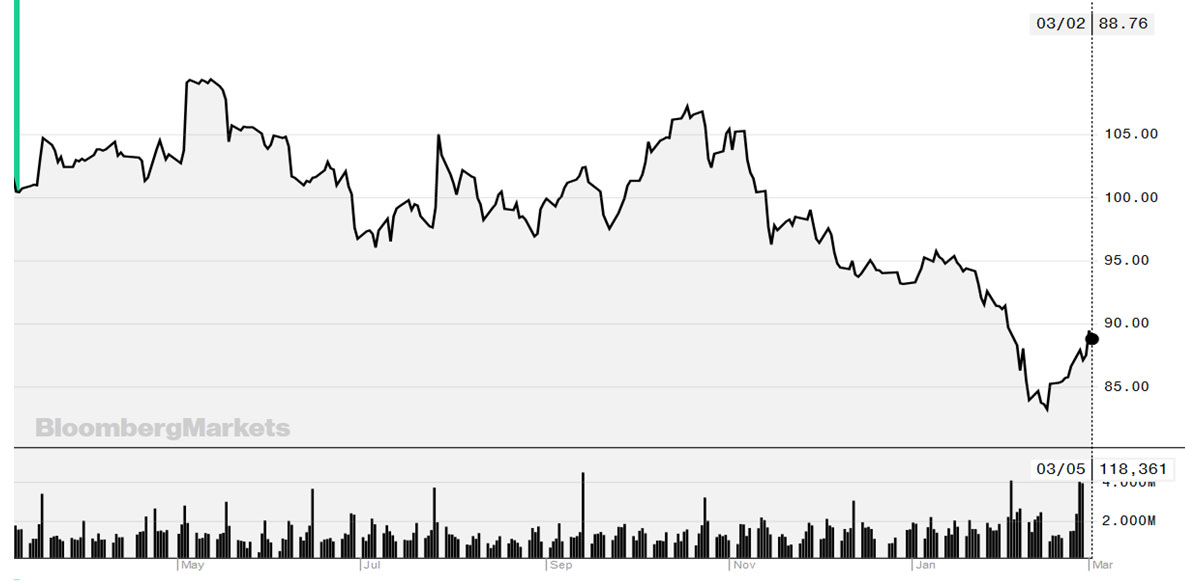

AB-InBev’s share price (EUR) March 2017 - March 2018