Sugar tax comes into effect

Sugar may be bad for you, but why is it the soft drinks industry that has to bear the brunt of a crackdown?

Two years after it was first mooted, the Government’s sugar tax came into effect on 6 April 2018, forcing drinks companies to pay between GBP 0.18 and GBP 0.24 (USD 0.24 - 0.32) for every litre of sugary drink they produce or import. Fruit juices, milk-based drinks and most alcoholic beverages are exempt, as are small companies manufacturing less than one million litres per year.

While the levy is small change compared with the sin taxes charged on alcohol and tobacco, it has the potential to significantly bump up the cost of some drinks, adding around GBP 0.50 to the price of a large bottle of Coke, or GBP 0.08 to that of a can.

Soft drinks companies have essentially been left with three choices: change their recipes to include less sugar; put up prices and risk putting off consumers or absorb the tax, which will hit profit margins and alienate investors.

While Coke and Pepsi have not changed their recipes and will pass the extra cost on to consumers, other companies, including Irn-Bru maker AG Barr and Suntory, the Japanese owner of Lucozade and Ribena, have used sweeteners to cut sugar levels and ensure virtually all of their drinks avoid the levy.

There is still a debate to be had about whether taxing drinks in this manner is the best way to improve the nation’s health. And while the jury is out, the government expects the tax to raise around GBP 520 million (USD 737 million) which will go to the Department of Education to be used to fund sports in primary schools.

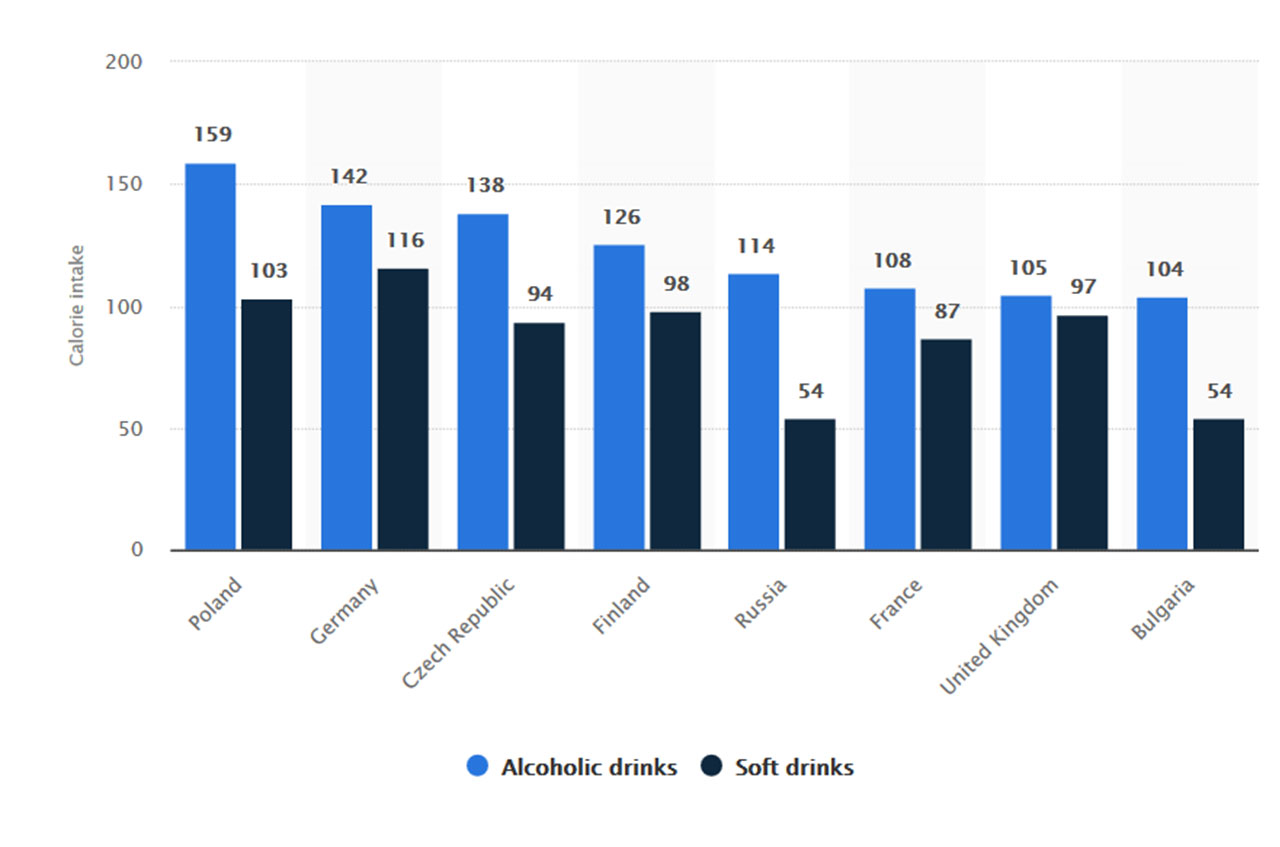

Calorie intake from soft drinks and alcohol per capita in selected European countries in 2016