Coke buys coffee shop chain Costa Coffee

Analysts are sceptical: Why is the Coca-Cola Company spending USD 5.1 billion on a chain of coffee shops, a business in which Coke has no experience? The company announced on 31 August 2018 it will buy Costa Coffee, a chain of British coffee shops, from hotel-operating conglomerate Whitbread to take on Starbucks. It was reported that Coke is paying a high price of 16.4 times Costa’s profits (EBITDA).

Coffee was missing from Coke’s portfolio of soft drinks, juices, teas, water and sports drinks. It is not clear why buying a physical coffee chain is the solution.

Coke’s CEO James Quincey explained the deal’s rationale by saying that Coca-Cola would leave existing management in place to operate the retail outlets. The plan appears to be to develop canned and bottled coffees bearing the Costa brand, which do not yet exist, and to plug these into Coca-Cola’s global distribution and marketing capabilities.

Mr Quincey also argued that Costa’s 4,800 locations will be key to building the brand, especially in emerging markets where coffee is less established.

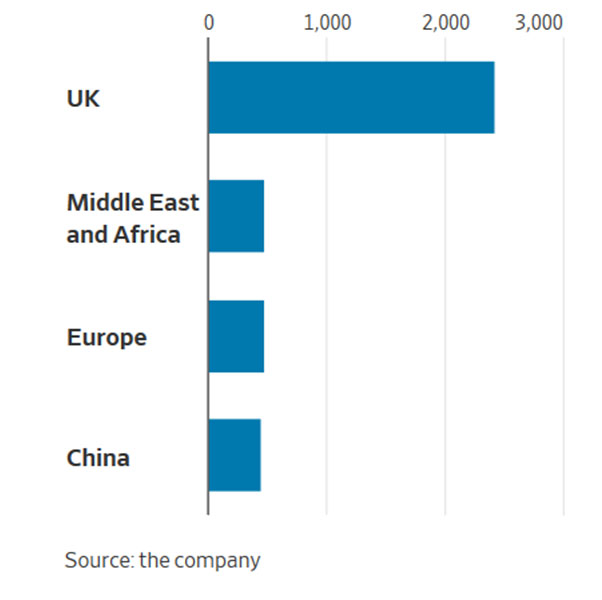

Costa has a presence in 32 countries, including 449 stores in China. It also operates vending machines. However, the UK’s locations contributed 88 percent to Costa’s turnover. What is more, Costa is not performing well in the UK and long-term problems loom large what with Brexit and a wobbly pound.

For some time, Whitbread – a former UK brewer – has faced investor pressure to sell the Costa unit. It bought Costa 23 years ago for GBP 19 million (then USD 30 million), when Costa had just 39 outlets.

Whitbread may call itself lucky that it managed to offload the chain to Coca-Cola. But Costa is no Starbucks in terms of global spread. Starbucks has over 23,000 stores world-wide. Coca-Cola may come to regret this caffeine binge, media commented.

Costa Coffee store count (2018)

Keywords

United Kingdom international beverage market

Authors

Ina Verstl

Source

BRAUWELT International 2018