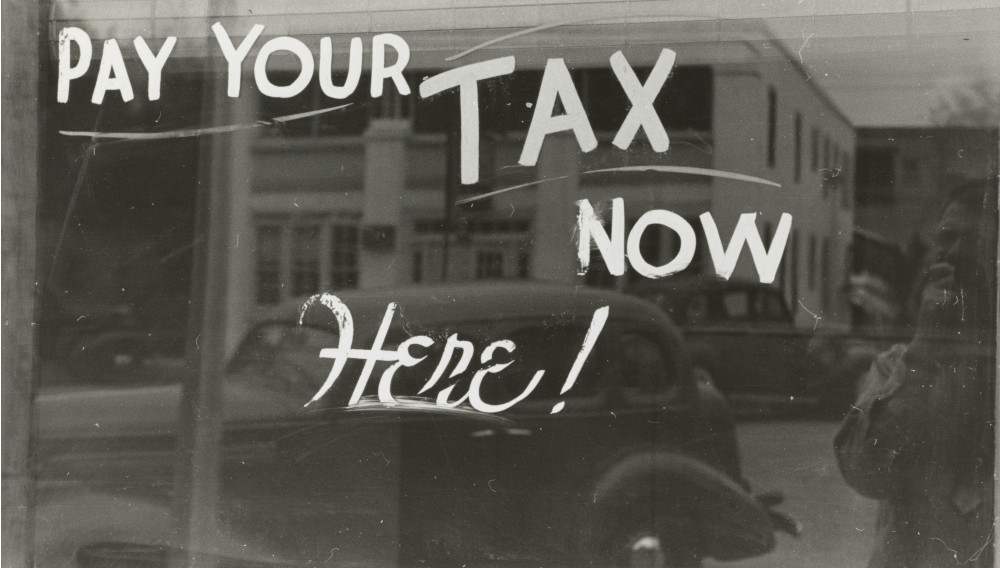

Australia’s taxman comes knocking to collect deferred excise payments

Australia | Just about all craft breweries will be struggling to pay their excise debts, incurred during the covid pandemic, when the Australian Tax Office (ATO) allowed a deferment of excise and other payments.

Since then, trade has not picked up, leaving many of the country’s 680 or so breweries with significant excise debts, the Australian website Brews News reported.

An administrator’s report, looking at Western Australia’s Running With Thieves brewery, which went into Voluntary Administration in August, revealed its parent company owed the ATO more than AUD 3.5 million (USD 2.3 million) at the time it called in the administrators.

The ATO clamps down

In October, the ATO cautioned businesses to “engage with their tax and super obligations to avoid having their debts disclosed to credit reporting agencies” in a move that could impact many businesses’ credit ratings.

“As the ATO shifts back to business-as-usual debt collection, as of July 2023 it has issued Notices of intent to disclose business tax debts to more than 22,000 businesses with a tax debt of at least AUD 100,000 that is overdue by more than 90 days,” the ATO said in a statement.

More than 9,000 firms had their debts disclosed in October.

Only 18 brewery closures to date

No one really knows how many craft breweries went under during and after the pandemic. The editor of Brews News, Matt Kirkegaard, said it is hard to give a definite figure, as breweries make quite a fanfare when they open, but tend to close very quietly. His records show that 18 breweries have closed since July 2022, but some of these had closed prior to that and he only noted them from that date.

There have been a number of breweries that have gone into voluntary administration, but survived having restructured. Mr Kirkegaard understands that interest in formal and informal administrations is growing.