No August beer tax hike

Australia | It is a bittersweet victory. The excise rates on alcohol didn’t go up in August. But not because the government relented and saw sense. It is because of a technicality.

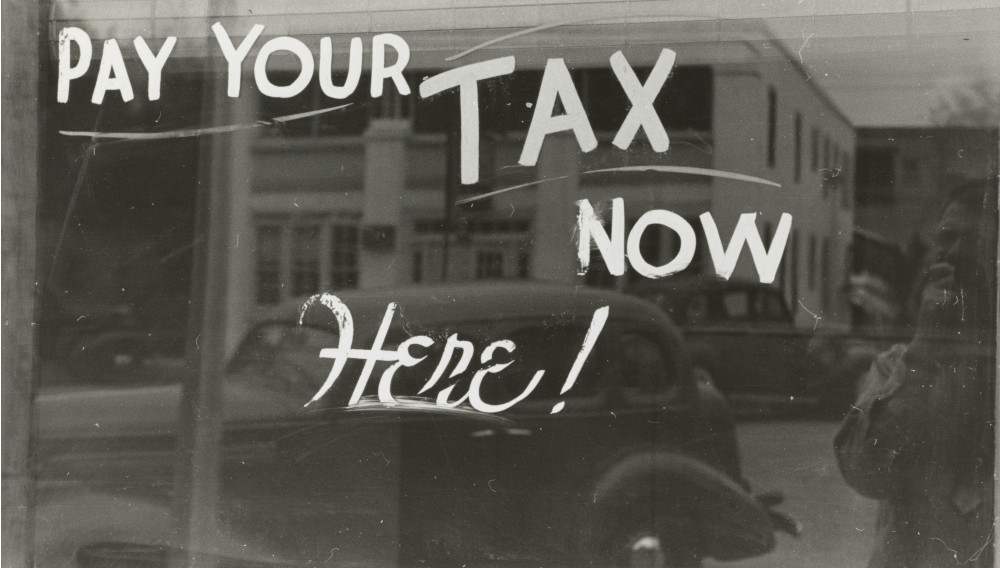

Excise rates are indexed twice a year in line with the consumer price index (CPI). This usually means the tax on alcohol goes up every February and August. The second increase for this year was scheduled for 3 August, but didn’t happen.

The Australian Taxation Office said: “The CPI indexation factor for rates from 3 August 2020 is 0.9850. As the factor is less than one, the rates do not change.”

Brewers had called on the government to cancel the August increase to help an industry hit hard by covid-19 restrictions.

Brett Heffernan, CEO of the Brewers Association of Australia (BA), commented that while it is good news that consumers will be spared the extra tax hit, the CPI fall comes because the economy is tanking due to the pandemic.

Tax is the most expensive ingredient

“It would be better for the government to remove the ambiguity and uncertainty of future tax increases by freezing the excise rate for, at least, 12 months. It will essentially cost them nothing to do so, but give the sector and consumers much-needed certainty,” Mr Heffernan added.

He went on to explain: “At AUD 2.26 (USD 1.63) per litre, Aussies already pay the fourth highest beer tax in the industrialised world. They then pay another 10 percent GST on top. A substantial 42 percent of the price of an Aussie-made stubby is tax. A typical carton of 4.9 percent alcohol beer retails for AUD 52.00 (USD 38) – of that, AUD 22.05 is tax. Australian drinkers are essentially shouting the taxman 10 of their 24 stubbies. […] Tax is the most expensive ingredient in Aussie beer. It’s not the inputs, production, freight, packaging, advertising or retail overheads and profits, it’s Australian government tax.”

The government had already dealt a blow to craft brewers on 20 July when ministers from Australia and New Zealand voted in favour of a prescribed colour scheme for pregnancy labelling, that will impose immediate and ongoing costs on brewers.

Mandatory colour scheme for labels

The colour scheme will require brewers to change their packaging due to the strict colour scheme that is being mandated, rather than just using contrasting colours already being used on labels.

The Independent Brewers Association (IBA), which represents about 600 craft brewers, has estimated that implementing the pregnancy warning design will cost its members in excess of AUD 113 million (USD 82 million) over the next ten years, including AUD 44 million (USD 32 million) in one-off costs.

This is equivalent to the salaries of over 1,600 people employed by small brewers across Australia, the IBA has worked out.

The IBA said that while it wholeheartedly supports the new pregnancy warning label, the decision to mandate excessive printing costs is “bureaucracy gone mad”.