ThaiBev rumoured to mull beer IPO in Singapore next year

Thailand | Is this a first step towards some sort of merger with AB-InBev? Media reported on 29 November 2019 that Thai Beverage (ThaiBev), Southeast Asia’s major brewer, is planning to spin off some regional beer assets in an initial public offering (IPO) in Singapore next year.

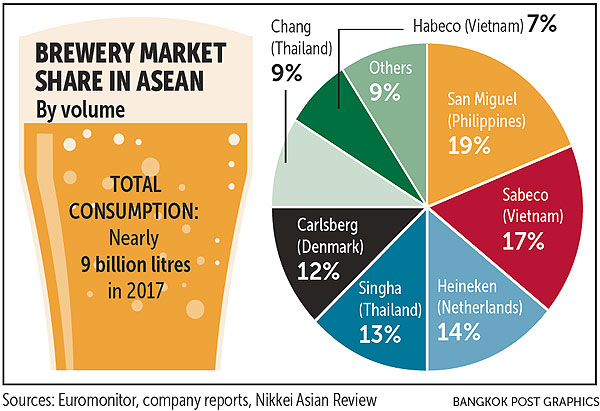

Pundits say that the IPO could raise as much as USD 3 billion. This would value the new company, housing ThaiBev’s assets in Thailand (Chang Beer) and Vietnam (Sabeco), at USD 10 billion.

Observers, who have looked at the figures, say that a valuation of USD 10 billion will imply a multiple of 23 times profits (EBITDA). That is fairly ambitious.

Sabeco is a prized asset

ThaiBev’s jewel in the crown is Sabeco. In 2017, ThaiBev agreed to buy a controlling stake (54 percent) in Sabeco, the country’s largest brewer, for about USD 4.8 billion.

Although headquartered in Bangkok, ThaiBev was listed on the Singapore stock exchange in 2003 through the consolidation of 58 beer and spirits businesses owned by Mr Charoen Sirivadhanabhakdi, Thailand’s richest man. According to the Nikkai Asian Review, Mr Sirivadhanabhakdi is ThaiBev’s controlling shareholder with a 45 percent stake. ThaiBev’s current market value is USD 16 billion.

Then as today, Singapore’s stock exchange is chosen because the Bangkok stock exchange restricts the listing of alcohol-related shares.

At this point, ThaiBev is only prepared to acknowledge that it is evaluating strategic proposals that include a potential listing of its beer business, among other options.

Read more about this topic: a glance at the southeast Asian beer market and Ina's appraisal why ThaiBev may spin off its beer business.