Investor criticises Kirin’s diversification strategy

Japan | The disgruntled UK-based investor FP has launched a campaign to persuade Kirin’s management to focus on beer, and ditch the “unrealistic hope” that it can thrive as a conglomerate that also includes food, biotechnology, pharmaceuticals and cosmetics.

In the secretive world of finance, the open criticism by one of Kirin's largest shareholders, voiced via the Financial Times newspaper in November 2019, is akin to a palace revolt. And that was before Kirin’s Australian unit Lion sold off its troubled dairy business, taking the unit’s total value destruction to a whopping AUD 3.8 billion (USD 2.6 billion).

Undauntedly, Kirin has published a midterm plan earlier this year, according to which it seeks to buy businesses that bridge the gap between pharmaceuticals and food and drink.

FP wants Kirin to change its strategy

Obviously, Independent Franchise Partners (FP) was not happy with this, and decided to engage publicly with Kirin’s management. In fact, FP is pushing for a wholesale change in Kirin's growth strategy.

The Financial Times says that FP has a 2 percent ownership interest and has held Kirin shares for six years. But in common with some other investors and analysts, FP is not convinced that by branching out into businesses that have nothing to do with beer, Kirin will deliver growth.

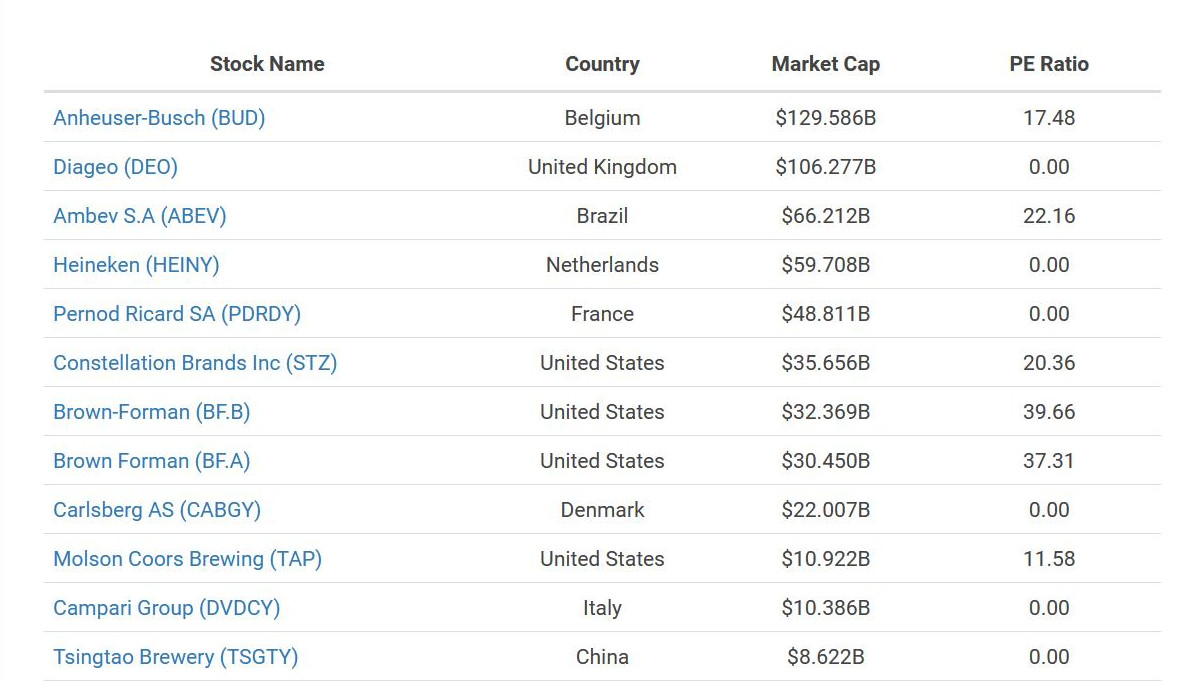

Investors have reason to be concerned. Kirin Holding’s share price is down 10 percent this year. Its market capitalisation is USD 19.7 billion (3 December 2019) per website macrotrends.net, and thus below Carlsberg’s.