Demographic outlook may hamper beer consumption growth

Currently, China has a per capita beer consumption figure of 32 litres. Brazilians drink 57 litres of beer per capita, Russians 81 litres and Indians 1 litre. To what extent this figures will rise in years to come depends to a large extent on the demographic change in these countries’ working-age populations.

The demographic outlook for the BRIC countries – Brazil, Russia, India and China – could hardly be more different. In terms of the demographic transition model, India is at the beginning of stage three (declining fertility, population growth), Brazil and China are at stage four (low mortality and fertility, population trending towards stability), while Russia is already at stage five (sub-replacement-rate fertility, declining population).

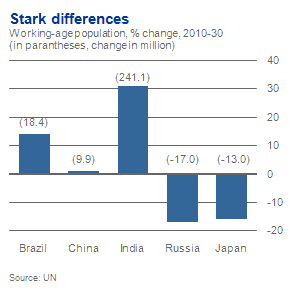

Not surprisingly, the differences in the projected change in the working-age population – the economically relevant population segment – are very significant in both absolute and relative terms.

The working-age population in India will increase by a stunning 240 million people (equivalent to four times the total population of the UK) over the next two decades, compared with a plus of 20 million people in Brazil. The working-age population in Russia, by contrast, will decline sharply by almost 20 million people, according to UN projections.

China’s working-age population will peak in 2015 and then gradually decline. By 2030 it will be merely 10 million people larger than today – a negligible change given a total population of 1.35 to 1.45 billion people.

By 2030, India will also have overtaken China as the world’s most populous country.

What could this mean for sustainable beer consumption? One thing is clear: unless the Chinese government manages to boost people’s incomes and consumption in decades to come, brewers will have to contend themselves with the hope that will more than double beer consumption in China by 2015. After that, who knows? But bringing up volume is one thing in China. Raising profits is another. As an old Miller Brewing Company annual report says: Beer is volume with profit. In China, even after 20 years of foreign brewers’ engagement, profits are slim.

Small wonder global brewers have stopped bragging about their investments in China.